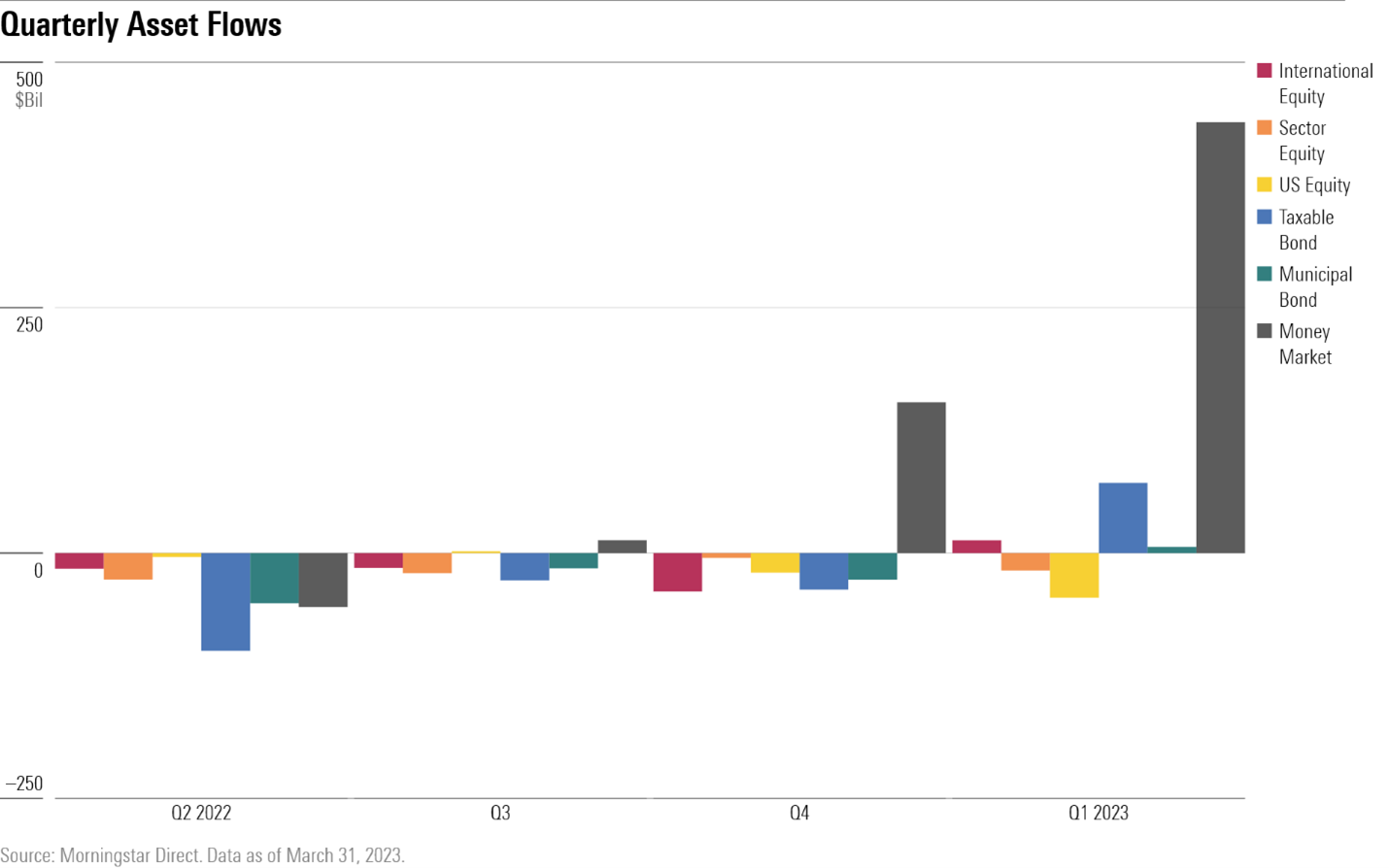

After a brutal year in 2022, fund investors started off 2023 in search of safety and yield.

During the first quarter, investors poured cash into money market funds at a pace not seen since the start of the pandemic, and they also moved into taxable- and municipal-bond funds.

It was a mixed picture for stocks in the first three months of the year, as investors exited U.S. stock and sector funds while hanging on to international-equity funds.

After a horrible year for bonds in 2022 that spurred investors to pull out more than $216 billion from fixed-income mutual funds and exchange-traded funds, they returned to bond funds in the first quarter. Attracted by the highest yields on fixed-income investments in years, investors moved $71.5 billion into taxable-bond funds.

Investors also tiptoed back into municipal-bond funds during the first quarter. Last year, tax-exempt bond funds saw net outflows equal to 11.2% of assets. But during the first quarter of 2023, muni-bond funds experienced $6.2 billion of inflows.

Money Market Inflows Dwarf Those for Long-Term Funds

The biggest trend in the first quarter was the race into money market funds. Investors poured more money into money market funds than into all long-term funds combined. Money market funds collected $439 billion in the quarter, the highest level since the first quarter of 2020.

Much of the move into money market funds appears to have come as savers pulled cash out of banks, driven by the twin catalysts of higher yields on money market funds when compared with bank accounts and fears over the safety of savings at some banks in the wake the regional bank crisis.

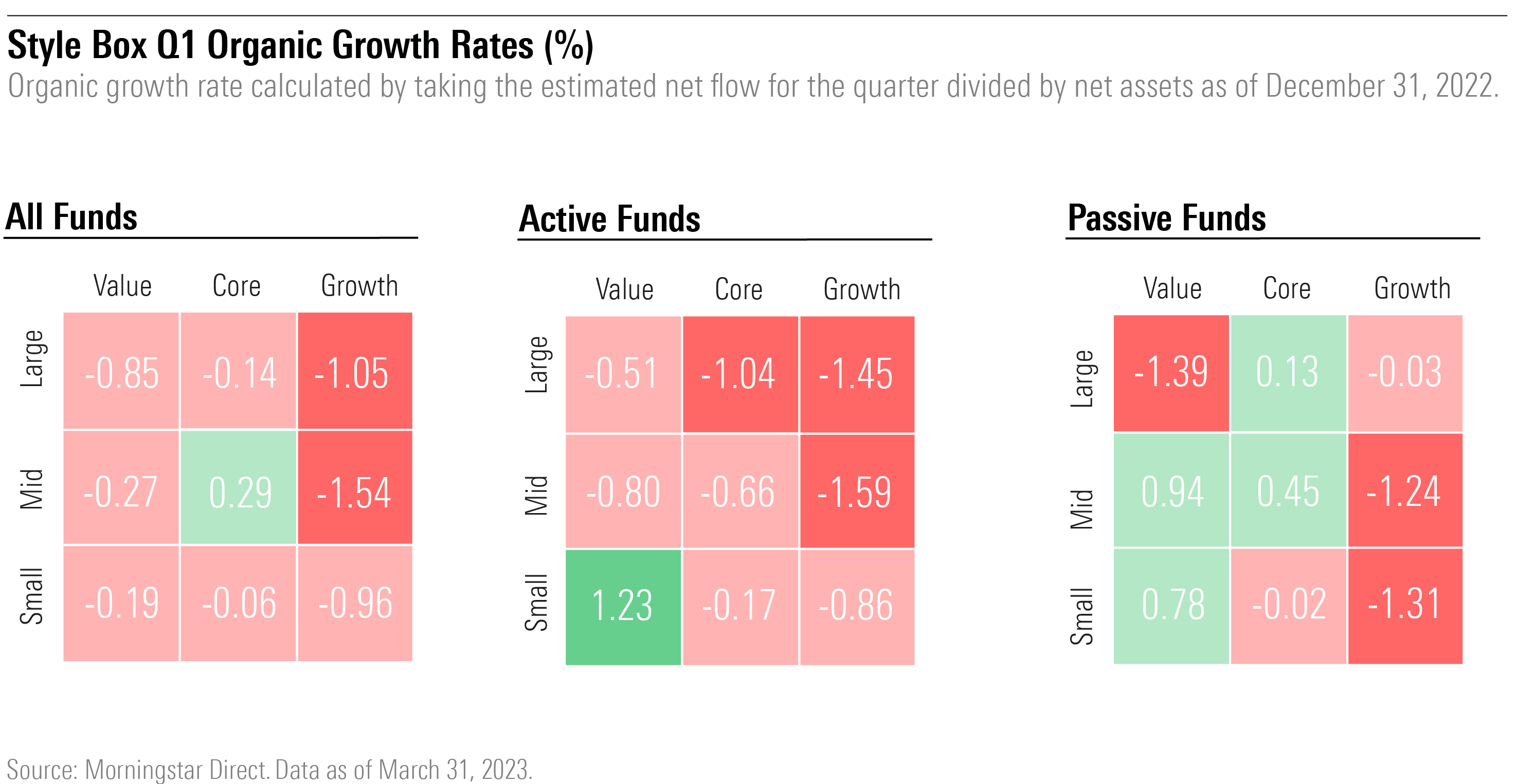

Mid-Cap Blend Funds Avoid Outflows

As investors poured into money market and bond funds, they pulled money out of almost all types of U.S. stock funds.

Growth funds greatly outperformed value in the first quarter but experienced larger outflows. The large-growth Morningstar Category shrunk by 1% just from outflows.

The $47.7 billion JPMorgan Large Cap Growth JLGMX experienced $6.6 billion of inflows, while the $52.2 billion T. Rowe Price Blue Chip Growth TRBCX saw $5.2 billion head out the door and the $169 billion Invesco QQQ ETF QQQ saw $2.3 billion leave.

Among active funds, only small-value funds experienced inflows.

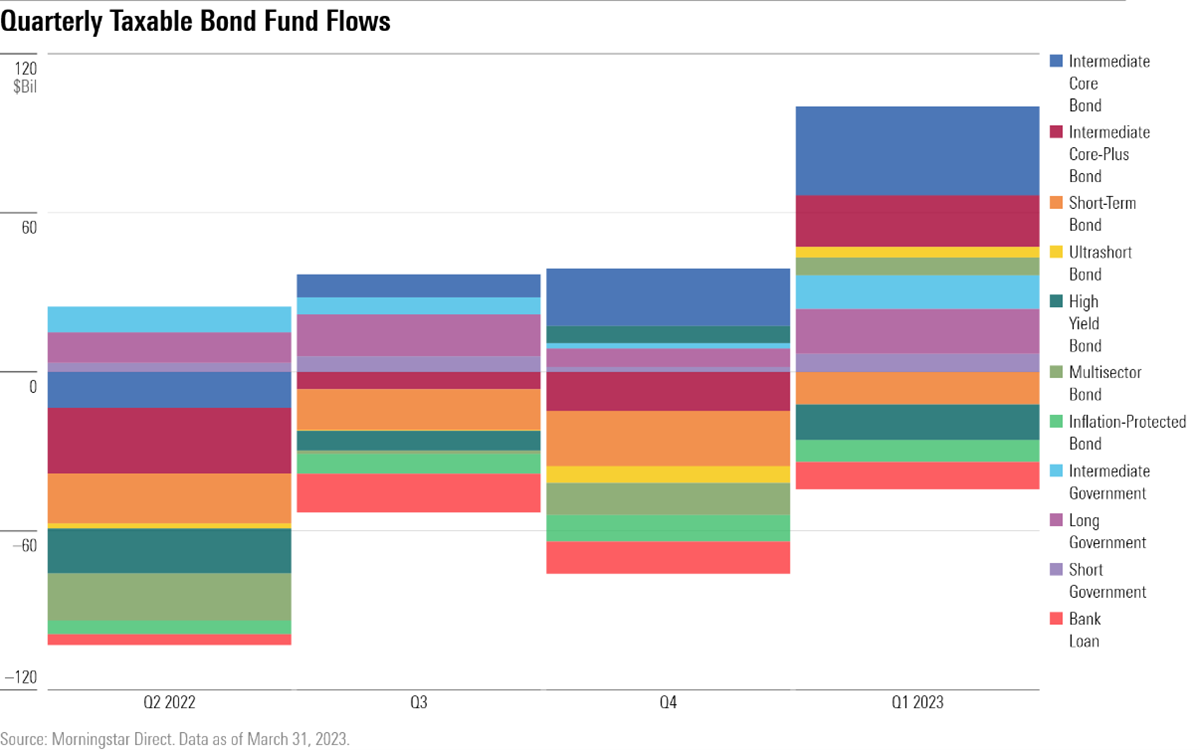

Intermediate-Term Bond Funds Lead Inflows

Among fixed-income funds, intermediate-term core and core-plus bond funds saw the most money heading in the door during in the first quarter. The $335.3 billion Vanguard Total Bond Market II Index VTBIX collected more than $12.6 billion.

Investors moved into long- and intermediate-term government funds. The $28.3 billion iShares 7-10 Year Treasury Bond ETF IEF and the $35.2 billion iShares 20+ Year Treasury Bond ETF TLT each recorded more than $5 billion of net inflows.

Investors exited high-yield bond funds and short-term funds. The $12.5 billion iShares iBoxx $ High Yield Corporate Bond ETF HYG saw $3.3 billion exit.

Treasury Inflation-Protected Securities funds also saw outflows the past four quarters. The $12.4 billion Schwab U.S. TIPS ETF SCHP saw $1.9 billion leave in the first quarter.

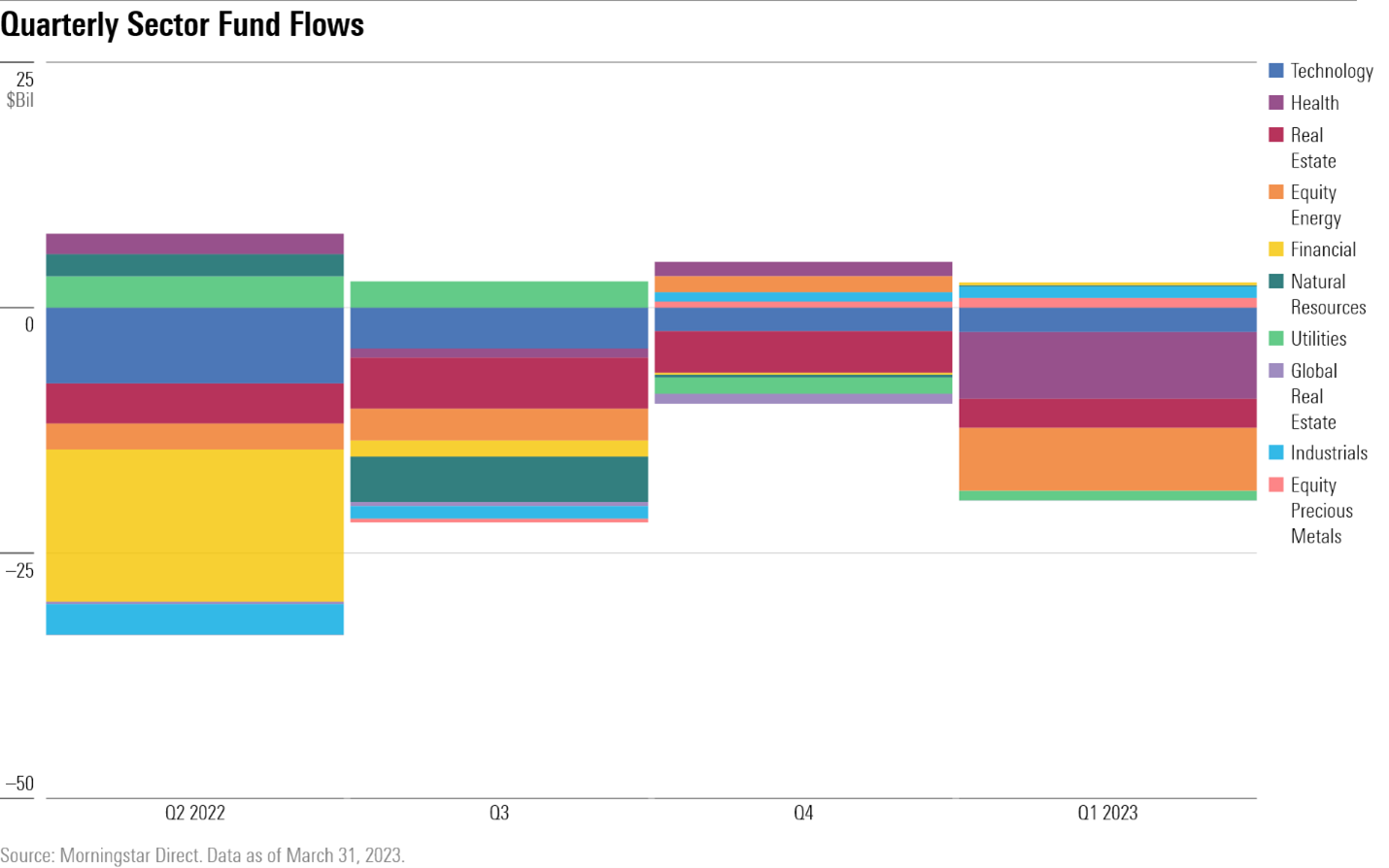

Large Outflows From Health and Energy Stock Funds

Health and energy funds saw the largest outflows among stock sector funds. Investors pulled $1.6 billion from the $40.1 billion Health Care Select Sector SPDR ETF XLV and $1.1 billion from the $682.5 million First Trust Energy AlphaDEX ETF FXN.

Investors ditched financial funds last year but returned to them in the first quarter. Investors poured $822 million into the $2.9 billion SPDR S&P Regional Banking ETF KRE in the first quarter.

Industrials and precious-metals funds saw inflows.

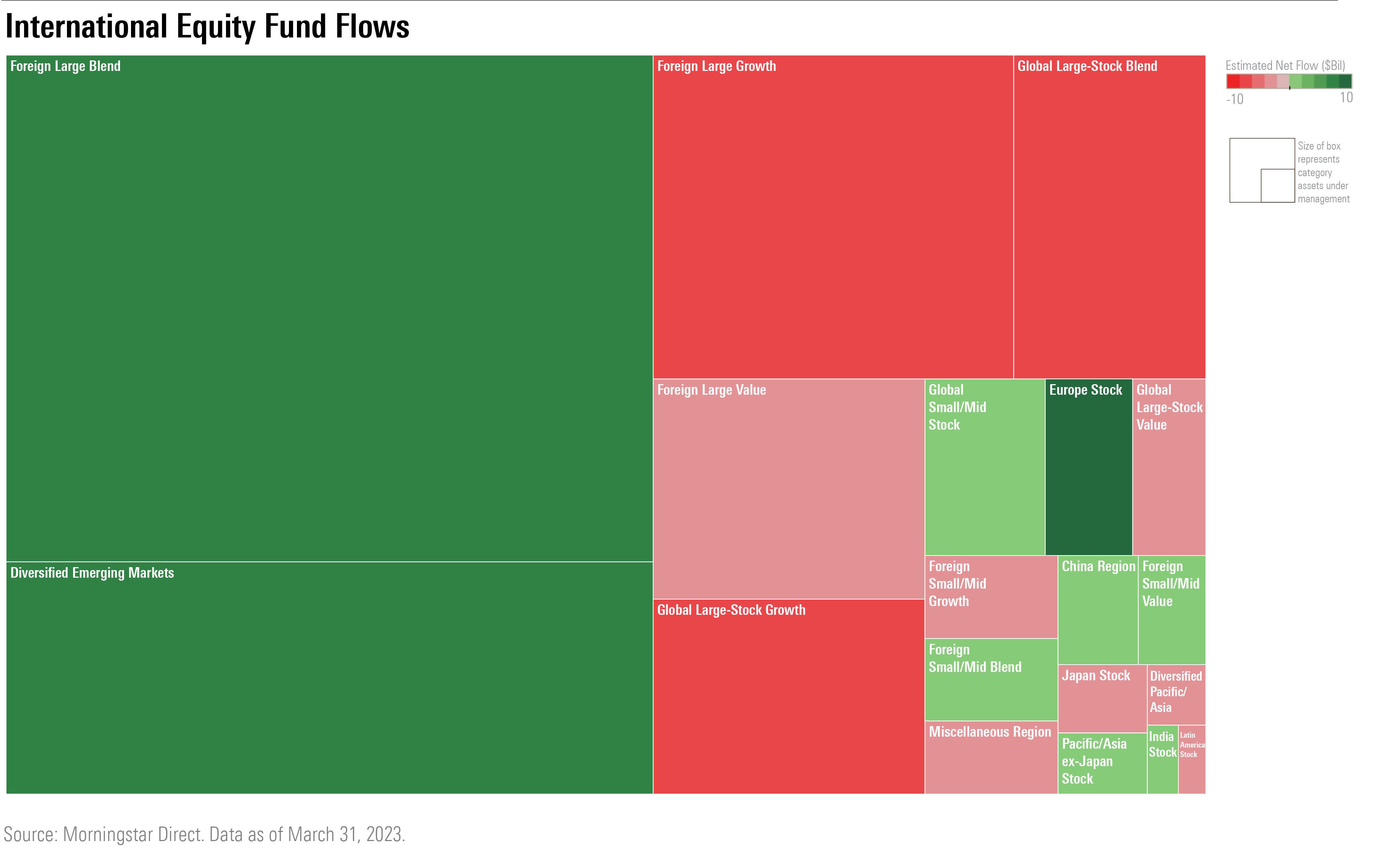

International-Equity Funds Act as a Haven

Though investors turned away from U.S. and stock sector funds, they stuck with international funds in the first quarter. Foreign large-blend funds, emerging-markets stock funds, and Europe stock funds were the most popular destinations.

The $9.6 billion JPMorgan BetaBuilders Europe ETF BBEU collected $5.7 billion, and the $69.2 billion iShares Core MSCI Emerging Markets ETF IEMG gathered $4.0 billion.

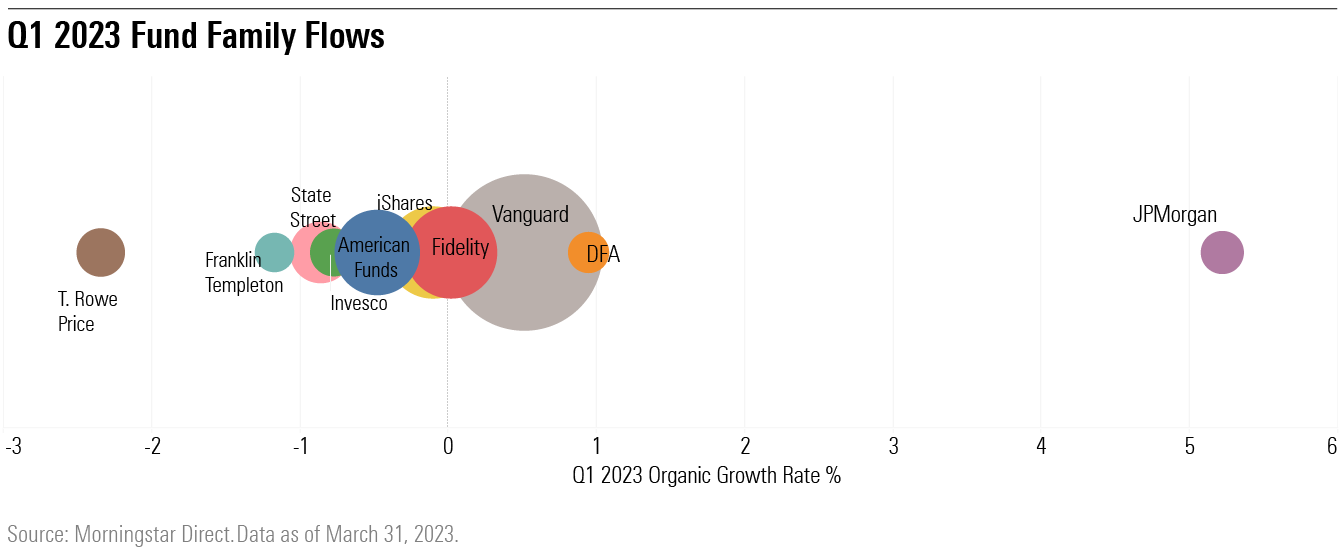

J.P. Morgan Grows the Fastest

Bolstered by inflows to a variety of funds across its lineup, J.P. Morgan grew the most among the biggest fund families in the first quarter when measured on an organic growth rate basis, which compares fund flows with starting assets. JPMorgan Large Cap Growth OLGAX, JPMorgan Equity Premium Income ETF JEPI, and JPMorgan BetaBuilders Europe ETF each collected more than $5 billion.

However, Vanguard saw the largest inflows on an overall basis, with $31.9 billion heading into its funds.

Among the 10 largest fund firms, T. Rowe Price saw the largest outflows during the first quarter at $14.2 billion. It was the 19th consecutive quarter of outflows for the firm.