What is a W-4?

A W-4 form, formally titled “Employee’s Withholding Certificate,” is an IRS tax document that employees fill out and submit to their employers. Employers use the information provided on a W-4 to calculate how much tax to withhold from an employee’s paycheck throughout the year.

Track your finances

A NerdWallet account is the smartest way to track your savings, credit cards, and investments together in one place.

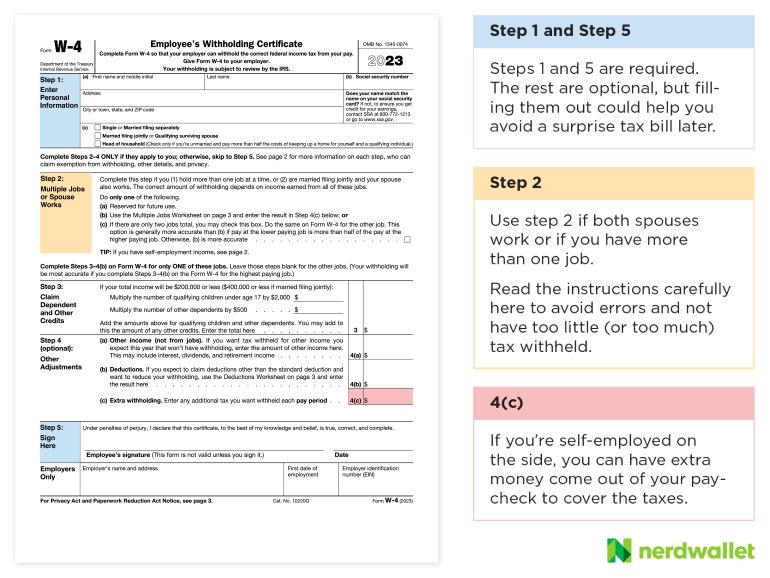

How to fill out a W-4 in 2023

Employers use the W-4 to calculate certain payroll taxes and remit the taxes to the IRS and state and local authorities (if applicable) on behalf of employees. How you fill out a W-4 can have a major effect on whether you’ll get a refund or you’ll owe taxes.

Step 1: Enter your personal information

Fill in your name, address, Social Security number and tax-filing status.

Importantly, your tax-filing status is the basis for which you might qualify for certain tax credits and deductions, and they are rules about which ones you can use.

Step 2: Account for multiple jobs

If you have more than one job, or you file jointly and your spouse works, follow the instructions to get more accurate withholding.

-

For the highest paying job’s W-4, fill out steps 2 through 4(b) of the W-4. Leave those steps blank on the W-4s for the other jobs.

-

If you (or you and your spouse) have a total of two jobs and make roughly the same amount at both, you can instead opt to check box 2(c) to indicate this. The catch: You’ll need to do this on both W-4s.

-

If you don’t want to reveal to your employer that you have a second job, or that you get income from other non-job sources, you have a few options:

-

On line 4(c), you can instruct your employer to withhold an extra amount of tax from your paycheck.

-

Alternatively, don’t factor the extra income into your W-4. Instead of having the tax come directly out of your paycheck, send estimated tax payments to the IRS yourself instead.

-

Step 3: Claim dependents, including children

If your total income is under $200,000 (or $400,000 if filing jointly), you can enter how many kids and dependents you have and multiply them by the credit amount. (See the rules about the child tax credit and for when you can claim a tax dependent.) You can also choose to not claim dependents — even if you have them — if you need more taxes taken out of your paycheck to reduce your tax bill.

Step 4: Refine your withholdings

If you want extra tax withheld, or expect to claim deductions other than the standard deduction when you do your taxes, you can note that.

Step 5: Sign and date your W-4

Once completed, give the signed form to your employer’s human resources or payroll team. You may also be able to fill it out online through your employer’s payroll system.

Is there a new W-4 form for 2023?

Yes. The IRS releases updated versions of certain tax forms each year to tweak language for clarity and to update references to certain figures, such as tax credits, that may be adjusted for inflation. The 2023 version of the W-4 form, pictured above, can be used by employees to adjust their withholding on their 2023 paychecks.

The 2024 W-4, which can be used to adjust withholdings on income earned in 2024, should become available on the IRS website by the end of 2023.

W-4 form 2023: How to find it

The agency also releases the W-4 form in several languages, including Chinese, Korean, Russian, Spanish and Vietnamese. You can access prior-year forms and FAQs on the website as well.

You may also be able to change your W-4 electronically through your employer’s payroll system.

Tax Filing Webinar — Jan. 17

File your taxes with confidence: Grab your limited spot to join the Tax Nerds in this one-hour session about tax filing and tax planning strategies.

Do I have to update my W-4 every year?

No. You are required to fill out a W-4 when you start a new job, but you do not have to fill out a new W-4 form every year if you already have one on file with your employer. However, it’s a good idea to check on your tax withholding at least annually and as your life changes. Events such as divorce, marriage, new dependents, or side gigs can trigger a change in tax liability.

The IRS encourages taxpayers to use its Tax Withholding Estimator to make sure their withholdings for the current year are on track. The estimator, available in both English and Spanish, can help you decide if you should make adjustments by completing a new W-4.

How to adjust your Form W-4

If you got a big tax bill when you filed your tax return last year and don’t want another, you can use Form W-4 to increase your withholding. That’ll help you owe less (or nothing) next time you file. If you got a big refund last year, you’re giving the government a free loan and could be accidentally living on less of your paycheck all year. If you want more of your paycheck sooner, rather than later, consider using Form W-4 to reduce your withholding.

Here are some steps you might take toward a specific outcome:

How to have more taxes taken out of your paycheck

If you want more taxes taken out of your paychecks, perhaps leading to a lower bill or atax refund when you file, here’s how you might adjust your W-4.

-

Reduce the number of dependents.

-

Add an extra amount to withhold on line 4(c).

How to have less tax taken out of your paycheck

If you want less money in taxes taken out of your paychecks, perhaps leading to having to pay a tax bill when you file your annual return, here’s how you might adjust your W-4.

-

Increase the number of dependents.

-

Reduce the number on line 4(a) or 4(c).

-

Increase the number on line 4(b).

How to use a W-4 to owe nothing on a tax return

If your objective is to engineer your paycheck withholdings so that you end up with a $0 tax bill when you file your annual return, then the accuracy of your W-4 is crucial.

-

Make sure your W-4 reflects your current family situation. If you had a baby or had a teenager who turned 18 this year, your tax situation is changing and you may want to update your W-4.

-

Accurately estimate your other sources of income. Capital gains, interest on investments, rental properties and freelancing are just some of the many other sources of non-job income that might be taxable and worth updating on line 4(a) of your W-4.

-

Accurately estimate your deductions. The W-4 assumes you’re taking the standard deduction when you file your tax return. If you plan to itemize (presumably because itemizing will cut your taxes more than the standard deduction will), you’ll want to estimate those extra deductions and change what’s on line 4(b).

-

Take advantage of the line for extra withholding. If you want to have a specific number of extra dollars withheld from each check for taxes, you can put that on line 4(c).

Need more help? There are worksheets in the Form W-4 instructions to help you estimate certain tax deductions you might have coming. The IRS’s W-4 estimator or NerdWallet’s tax calculator can also help.

Get ready for simple tax filing with a $50 flat fee for every scenario

Powered by

Don’t miss out during the 2024 tax season. Register for a NerdWallet account to gain access to a tax product powered by Column Tax for a flat rate of $50 in 2024, credit score tracking, personalized recommendations, timely alerts, and more.

for a NerdWallet account

W-4 calculator

Use our free W-4 withholding calculator below to get a general idea of how your tax withholding is stacking up this year. To use the estimator, locate your paystubs and use them to enter your current state and federal withholdings.

What else to know about Form W-4

1. Has the W-4 form changed?

Yes. In the past, employees could claim allowances on their W-4 to lower the amount of federal income tax withheld from their wages. The more withholding allowances an employee claimed, the less their employer would withhold from their paychecks. However, the 2017 Tax Cuts and Jobs Act overhauled a lot of tax rules, including doing away with personal exemptions. That prompted the IRS to change the W-4 form.

The new W-4, introduced in 2020, still asks for basic personal information, but no longer asks for a number of allowances. Now, employees who want to lower their tax withholding must claim dependents or use a deductions worksheet.

2. What does it mean to be exempt from taxes?

Being exempt means your employer won’t withhold federal income tax from your pay. (Social Security and Medicare taxes will still come out of your check, though.) Generally, the only way you can be exempt from withholding is if two things are true:

-

You got a refund of all your federal income tax withheld last year because you had no tax liability, and

-

You expect the same thing to happen this year.

If you are exempt from withholding, write “exempt” in the space below step 4(c). You still need to complete steps 1 and 5. Also, you’ll need to submit a new W-4 every year if you plan to keep claiming exemption from withholding.

3. When should I review my W-4?

You can change your W-4 at any time, but if any of these things happen to you during the year you might especially want to update your W-4 so your withholdings reflect your tax life:

-

You get married or divorced.

-

You take a pay cut or get a big raise.

-

You work only part of the year.

-

You or your spouse freelance on the side.

4. Can I adjust my W-4 multiple times throughout the year?

Tinkering is OK. You’re allowed to give your employer a new W-4 at any time. That means you can fill out a W-4, give it to your employer and then review your next paycheck to see how much money was withheld. Then you can start estimating how much you’ll have taken out of your paychecks for the full year.

If it doesn’t seem like it’ll be enough to cover your whole tax bill, or if it seems like it’ll end up being way too much, you can submit another W-4 and adjust.

If you want an extra set amount withheld from each paycheck to cover taxes on freelance income or other income, you can enter it on lines 4(a) and 4(c) of Form W-4.

Why do you have to fill out a W-4?

What is the difference between a W-2 and a W-4?