It’s that time of the year again: The lights are strung, the Starbucks holiday drinks are flowing and retailers are gearing up for their biggest shopping events.

It’s also when consumers increase their spending in anticipation of the holidays. Nearly four in five Americans (79 percent) plan to shop this holiday season, and searching for the best deals to maximize their budgets is just another part of the season.

American plan to spend $875 on gifts and holiday items such as decorations and food this year, slightly up from 2022, according to the National Retail Federation (NRF). And much of that shopping is still happening in person, despite the rise of e-commerce: 61 percent of holiday shoppers plan to do at least some of their shopping in person, according to Bankrate research.

But in many cities, consumers could spend more on gifts and holiday items this year. Prices of goods and services vary significantly from city to city — and even from store to store within the same city.

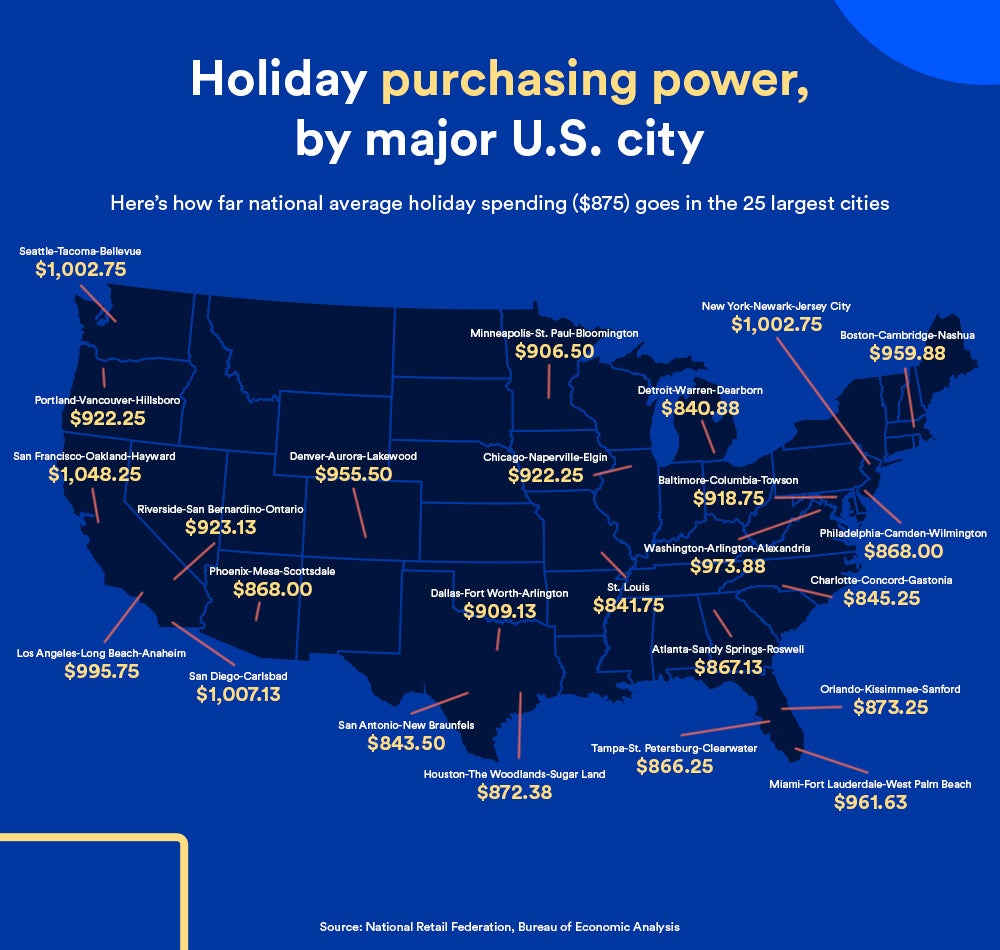

To illustrate these differences, we analyzed how far national average holiday spending ($875) in 2023 goes in the 25 largest cities. We found that residents in Detroit and St. Louis are able to spend less to buy an equivalent amount of gifts and holiday items as the average American buys, meaning their dollars go farther. Bankrate also analyzed sales tax rates, median income after housing costs, average credit card balances and the number of retail stores in the nation’s 25 largest metro areas to determine which cities offer the most favorable conditions for in-person holiday shopping.

Key takeaways

- The best city for local holiday shoppers is Detroit, ranking well for affordability and retail accessibility. Boston, Philadelphia, Charlotte and Baltimore round out the top five.

- The worst city for local holiday shoppers is Seattle, followed by Los Angeles, Riverside, Miami and San Francisco.

- Detroit, St. Louis and San Antonio are the top places among the 25 largest metros where residents’ dollars go furthest for in-person holiday shopping. In Detroit, residents only have to spend $840.88 to buy the equivalent of $875, the national average that Americans spend on gifts and holiday items.

The best and worst cities for local holiday shoppers

Where you live has a significant impact on how far your dollars can stretch for holiday shopping, from the prices of gifts and holiday items in your area to what stores you can access to shop around and compare prices.

Bankrate’s research found Detroit ranks toward the top for five out of the six metrics analyzed, making it the best city for its locals to holiday shop. The city of nearly 4.3 million residents offers the most affordable goods and services of the 25 largest metros, though residents have less disposable income after accounting for median housing costs ($57,789 annually) compared to other cities, according to data analyzed from the U.S. Census and the Bureau of Economic Analysis.

Detroit also has the most retail shops for every 10,000 establishments and ranks 3rd for retail stores per capita, offering locals more choices to shop and less crowds. The Motor City tied 2nd with Washington D.C. and Baltimore for having the second lowest sales tax rate (6.00 percent). Additionally, residents in Michigan have the lowest average credit card balance, which can alleviate some budgetary strain. Boston, Philadelphia, Charlotte and Baltimore round out the top five best cities for local holiday shoppers.

Seattle, on the other hand, held last place in our ranking. Back-of-the-pack scores in affordability and retail accessibility dragged down the Emerald City. Seattle has the third most expensive prices and the highest sales tax rate (10.25 percent) compared to the other metros, which contributes to its low affordability ranking. Seattle also has limited shopping options compared to other cities: It landed in the 23rd spot for the number of retail establishments per 10,000 establishments and in the 20th spot for retail establishments per capita. However, the bottom city does have one redeeming quality: after accounting for housing costs, Seattleites bring home bigger paychecks (a median of $83,365 annually) compared to those in other cities, boosting their local buying power.

In addition to Seattle, the remaining four worst cities for local holiday shoppers are Los Angeles, Riverside, Miami and San Francisco, primarily due to their high prices of goods and services compared to other cities. Three cities in the bottom five are in California.

| Best cities for local holiday shoppers | Worst cities for local holiday shoppers |

|---|---|

| *2nd and 22nd places are tied. | |

| 1. Detroit, MI | 25. Seattle, WA |

| 2. Boston, MA and Philadelphia, PA* | 24. Los Angeles, CA |

| 4. Charlotte, NC | 22. Miami, FL and Riverside, CA* |

| 5. Baltimore, MD | 21. San Francisco, CA |

The map below shows how far your dollars go for holiday shopping in the 25 largest cities, compared to the national average that Americans spend on gifts and holiday items ($875). At one extreme is Detroit, where you only have to spend $840.88 to buy the equivalent of $875. At the other extreme is San Francisco, where you have to spend $1,048.25 to buy the equivalent of $875. There are broader regional trends, too: The places where $875 buys the least are concentrated around large cities in the Northeast and California. Conversely, $875 stretches the most in cities concentrated in the Midwest and the Southeast.

- Purchasing power

- The amount of goods and services you can buy with U.S. dollars.

Retail experts expect this holiday season to resemble 2022 in several ways, with a slight boost in consumer spending. That includes an early start to holiday shopping, increased discounts and sales and consumers engaging in both online and in-store shopping. Deloitte projects a 3.5 percent to 4.6 percent increase in 2023 holiday sales and a 10.3 percent to 12.8 percent increase in 2023 holiday online sales compared to 2022.

“Consumers plan to spend more but plan to buy fewer gifts,” a Deloitte spokesperson said in an email to Bankrate. “In general, consumers are factoring in inflation. Three-quarters are expecting higher prices year-over-year.”

With ongoing inflation, record credit card balances and the resumption of student loan payments, consumers are spreading out their shopping between October and December to cover the costs that come with the holiday season. While consumer spending has shown resilience in recent months and inflation has significantly eased from its peak last year, over half (54 percent) of holiday shoppers expect to feel financially burdened this year, a Bankrate holiday shopping survey found. Specifically, 33 percent expect inflation to impact their shopping habits, 25 percent are stressed about the cost of holiday shopping, 23 percent say it will strain their budgets and 13 percent expect to feel pressured to spend more than they’re comfortable with.

“More than half of people tell us that they spend too much money at the holidays and that’s been consistent year over year,” says Rod Griffin, senior director of public education and advocacy at Experian. “I don’t think that will change, even with the economy at an interesting point.”

As macroeconomic pressures persist, holiday shoppers plan to respond by stretching their dollars in any way possible. Forty-two percent of holiday shoppers are planning to buy fewer items and 41 percent are seeking out more coupons, discounts or sales, while 20 percent plan to purchase cheaper brands, according to Bankrate’s holiday shopping survey.

Experts share their secrets for saving money during the holidays

To help you manage your holiday budget and get the best deals possible, Bankrate spoke to experts and everyday people to get their best tips. Here are the shopping strategies they are implementing during the 2023 holiday season:

1. Earn discounts with coupons and cash back sites

Whether you’re shopping online or in-person, one of the easiest ways to get discounts on your holiday purchases is by using coupon and cash back sites.

Retail expert Trae Bodge uses coupon sites, like CouponCabin and Paypal Honey, every time she shops to save a little here and there. CouponCabin also provides printable coupons to shop in person, and there are hundreds of retailers that participate. Consider doing as much as online research as possible, such as checking prices online and finding coupons, before shopping in person, especially if you’re living in one of the higher-cost cities on our ranking.

“You’re leaving money on the table if you’re not using those,” Bodge says.

2. Leverage credit card rewards

Justine Nelson, a 35-year-old mom of two based in Los Angeles and founder of Debt Free Millennials, likes to strategically leverage her credit card rewards to save on holiday shopping. By using her Chase Sapphire Preferred® Card for purchases throughout the year and paying off her balance in full every month, Nelson has accumulated $600 worth of Chase points that she plans to use toward holiday shopping this year. Those points will cover roughly half of her holiday budget, which she anticipates to be around $1,200.

“One way to offset some of your holiday spending costs is by utilizing credit card points that may already be just sitting in your account,” she says.

But Nelson advises against following her strategy if you aren’t able to pay your credit card off in full every month, especially in lieu of rising interest rates. Her philosophy when it comes to credit cards is: “You only move as fast as cash.”

3. Stack your rewards

Bodge also likes reward stacking, or combining several shopping rewards programs to maximize the discounts, points and cash back she receives on a purchase. For example, Bodge will use a credit card that allows her to earn cash back, and also use printable coupons from CouponCabin to earn discounts when making purchases in person.

“I’m always aware of what credit cards to use and try to be strategic with what I buy with it to maximize the benefits on my credit card,” Bodge says. She estimates she saves hundreds of dollars every year by implementing reward stacking into her holiday shopping.

Money tip:

If you want to take your credit card strategy to the next level to earn cash back and points for the holidays, Bankrate recommends starting with one of these rewards credit cards.

4. Always compare prices when shopping

Pricing and promotions vary significantly by store, so checking prices of items in your area or online before purchasing can save you a lot of money. Many big box stores, like Target and Walmart, will even match the price of any identical item you find for less at a competitor or on their website.

Kiersti Torok, a 32-year-old mom based in Nebraska and couponing expert, recommends using a browser extension called CamelCamelCamel to check and monitor prices if you plan to do a lot of your holiday shopping on Amazon. You also can set up alerts for Amazon products on your gift list for when prices drop.

“You can see what the lowest price has been for the past year, and see what value you’re getting and whether or not it’s actually a good deal,” Torok says.

Other browsing extensions, like CNET Shopping or Brickseek.com, allow you to compare prices on different websites and stores to ensure you’re getting the lowest price for an item. BrickSeek.com, for example, has inventory checkers for 13 major retailers including Target, Walmart, Home Depot and Lowes.

“I have a Walmart that’s five minutes away from my house, and one that’s ten minutes away. The one that’s ten minutes away from my house is usually about 10 to 20 percent more expensive than the one that’s closest to my house,” Torok says. “It’s nuts.”

5. Don’t view gift cards as a ‘cop-out’

Giving a gift card is typically seen as a cop-out during the holidays, but Bodge wants to dispel that myth. She says the “big money waster” is buying the wrong gift for someone.

“Don’t take a chance, and just buy a gift card if you’re unsure of what to get someone,” Bodge says.

Torok also recommends leveraging gift cards as part of your holiday shopping strategy. If your family budget is tight for the holidays, Torok recommends giving your kids gift cards in December and taking them shopping in January when all the toys get marked 70 percent off.

“It happens every year like clockwork,” she says. “It’ll be about three weeks after Christmas, and then mid-July to mid-August is when you see those big toy sales. That’s because every year retailers do a big retail shift out for toys and all of the holiday stuff from the last season.”

6. Curb impulse spending by planning and setting limits

Bodge knows that many Americans struggle with impulse shopping — and it’s even harder to resist during the holidays.

“It’s so easy to buy things,” she says. “We know with TikTok Shop, for example, you can buy something in 30 seconds off TikTok. And also shopping online is easier than ever. Your favorite online shopping platforms have your credit card right there.

To avoid overspending, compile a list of recipients, look at your budget and set parameters on how much you want to spend on each person. If you’re overspending on yourself, Bodge suggests adding yourself to your shopping list and setting a price limit. She also recommends removing some of that ease of online shopping by unsubscribing to marketing emails, staying away from TikTok and taking your credit card off of retailers you shop with frequently.

“Make it a little bit more difficult to shop, so you’ll stop and be more mindful,” Bodge says.

Setting savings aside and budgeting ahead of the holidays can also be a way to give yourself an extra cushion of money to use when buying gifts. It might be too late to start a holiday savings account this year, but you can make it a point to start one in January for holiday shopping in 2024.

Stash away small, non-intimidating amounts of money — think $10 or $20 each week — in the savings account over the course of a few months to take some pressure off your budget during the holidays. Be sure to put the money into a high-yield savings account, so you can grow your savings a little bit faster thanks to the higher interest rate the accounts offer.

7. Talk openly with family and friends about holiday budgets

One thing that Griffin, a 55-year-old based in Dallas, does every year to prepare for the holidays is talk openly to his wife and daughters about what they can afford to spend.

“I have three daughters and seven grandchildren, so we talk about how we’re going to buy gifts and how much we can afford because we’re not all at the same economic level,” he says. “We set limits for how much we are going to spend that are achievable and comfortable for everyone in our family.”

Griffin says those conversations typically start the year prior, so there’s plenty of time for everyone in his family to get on the same page and shop the best deals throughout the year.

If you feel the pressure to keep up with the Joneses during the holiday season, Bodge says it’s OK to “be the brave one and say something and create a new tradition.”

“This is a tough conversation to have, but my guess would be that other family members or other coworkers would appreciate the fact that you had the nerve to broach that topic and make that suggestion,” Bodge says.

See where your city ranks for holiday shopping

Bankrate analyzed the 25 largest metro areas in the U.S. based on several factors you should consider when holiday shopping in your area. Use the table below to see how your city stacks up against others:

Methodology

Bankrate’s Best and Worst Cities for Local Holiday Shoppers was compiled using data from a variety of sources, including the U.S. Census Bureau, U.S. Labor Department (BLS) and U.S. Bureau of Economic Analysis (BEA). Bankrate analyzed the 25 largest metro areas in the U.S. based on several factors a resident should consider when shopping for the holidays in their city. That includes affordability, local purchasing power and retail accessibility. Here is a breakdown of each category:

Affordability: To measure affordability, Bankrate calculated the amount of money needed in the 25 largest metro areas to buy the same quantity of goods and services as the 2023 national average ($875). The average amount Americans plan to spend on gifts and holiday items this year is based on the National Retail Federation’s (NRF) latest consumer survey. NRF holiday spending is defined as the months of November and December. To calculate how the average holiday spend translates in each metro, Bankrate multiplied the national average holiday spend by the metro’s 2021 regional price parity index (RPP). RPPs from the BEA give a sense of how much higher or lower effective prices are in an area relative to the nation overall, as well as between cities. A higher RPP in a metro negatively affects its ranking, and a lower RPP in a metro positively affects its ranking. Bankrate also factored in total sales tax rates in the 25 largest metros, as of July 1, 2021. If a metropolitan area encompassed several cities, the largest city was chosen within a metro to represent the total sales tax rates. For example, Bankrate chose to represent the New York City sales tax rate for the New York-Jersey City-Newark metropolitan area. This category was given an overall weight of 35 percent.

Purchasing Power: To measure local purchasing power, Bankrate analyzed median income after housing costs in the 25 largest metros. Data on median income and median monthly housing costs were collected from the most recent American Community Survey (2022). Higher median income after housing costs in a metro positively impacts its ranking. Bankrate also used TransUnion data from March 2023 to analyze average credit card balances in the states the metropolitan areas are in. State credit card balances were averaged for metropolitan areas that cross multiple state lines. A higher credit card balance in a metro negatively impacts its ranking. This category was given an overall weight of 35 percent.

Retail Store Accessibility: To measure accessibility to retail stores, Bankrate analyzed retail trade establishments per 100,000 people and retail trade establishments per 10,000 establishments from the U.S. Census Bureau (2021). Retail trade establishments per 100,000 people can be an indicator of long lines and crowds. The fewer shops per capita, the more people there could be in each store creating lines and crowds. Retail trade establishments per 10,000 establishments can be an indicator of retail store options for consumers to shop around and price check. The more stores there are to shop around and price check in a given metro, the better for the consumer. This category was given an overall weight of 30 percent.