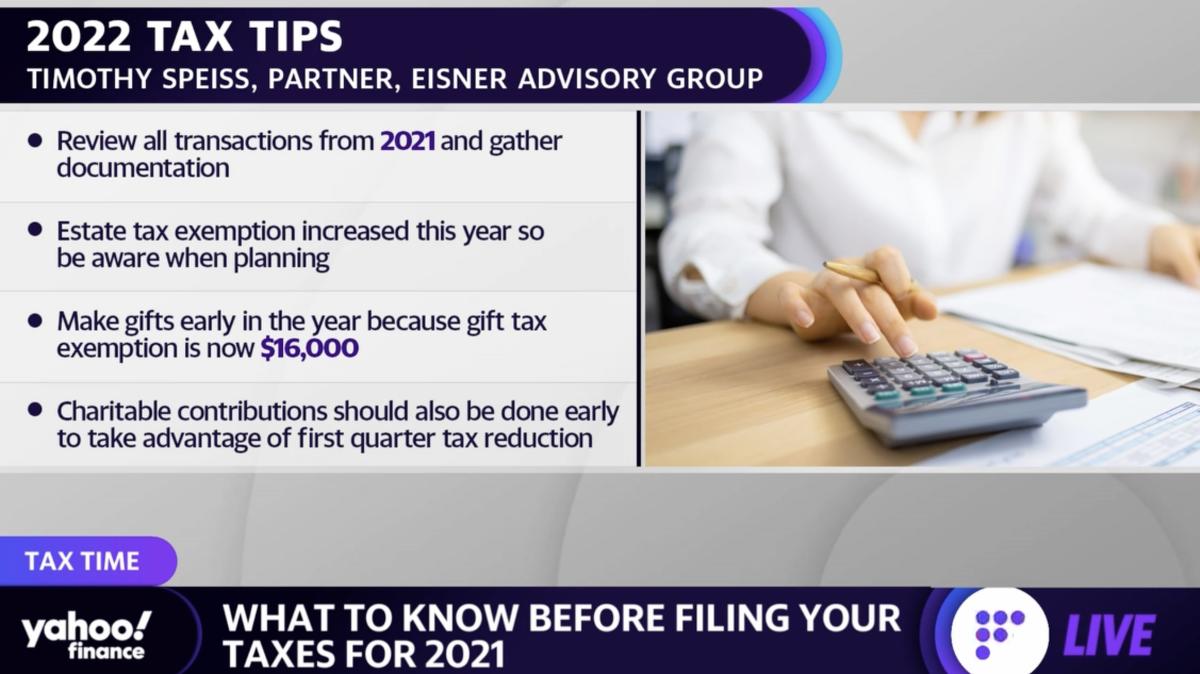

Tim Speiss, EisnerAmper Partner & CPA, joins Yahoo Finance Live to discuss what to be aware of when filing 2021 taxes, the child tax credit, the gift tax exemption, and expected IRS backlogs.

Video Transcript

– All right. Let’s switch gears and talk a little tax time. Because it seems to have snuck up on us, but the 2022 tax filing season officially kicks off today. So how has the pandemic and higher inflation impacted tax season? To help us answer some of these questions, let’s bring in Tim Speiss, EisnerAmper Partner and CPA.

So Tim, I know the season starts today. I just want to get this sort of housekeeping rule out of the way. What is the deadline for returns? Because I know the deadline changed the past two years because of the pandemic.

TIM SPEISS: Right. Well, right now, as far as we know, it’s April 15. But we will see how that goes.

– And so how does this tax season look different from last year? Because there are some things like child tax credits that one has to take into account this year.

TIM SPEISS: Right. That’s a very good point. And I was going to speak to that later, when we talk about benefit plans generally and employer plans. But that’s correct. The other is the gift tax exemption, which is now $16,000 per person. For a married couple, that’s $32,000. And the estate exemption, which I’ll briefly touch on, is now increased to a little bit over $12 million– $12.06– and $24.12 million for a married couple.

And those are three things– child care, thinking about estate planning early in the year, making gifts early in the year. That’s a good way to start this segment.

TIM SPEISS: What about the tax brackets? And how have they changed because of higher inflation?

TIM SPEISS: Well, the brackets have gone up. They’re a little bit more confiscatory. But on par, they’re pretty similar to the 2020 tax brackets. Remember, now we’re in 2021. We’re filing 2021 tax filings now, this year, in ’22. So I would say they’re not– they’ve expanded– probably from 0 to $400,000, the brackets have expanded. They’ve increased slightly.

And I would say that as you’re looking at your 2021 information for tax filing purposes, the tax brackets and where you are and your income tax liabilities projected for 2022 should also equally be considered. And now would be the time to adjust withholding exemptions, employee benefit plan elections contributions or 401(k) plans and the like.

– And what should people be aware when it comes to estate tax exemption, because that increased this year, correct?

TIM SPEISS: Oh, absolutely. Yes. I mentioned that for a single person, it’s $12.06, a married couple is $24.12. And there’s tremendous opportunities there. We assist clients with establishing, for example, LLCs or partnerships for their investment portfolios. Your previous guest talked about investments generally, and that’s important.

So in the context of just investment planning, risk tolerance is extremely important. Understanding what your particular risk is. It’s good to work with a professional. You can actually measure your risk tolerance to design a portfolio, and you can rebalance as you go. Some sectors, as your earlier guest spoke about this m are going to be experiencing volatility. There’ll probably be volatility generally. So re-looking at your asset allocation and sectors is also appropriate.

– What about the backlog the IRS continues to struggle with, as it relates to the child tax credit, even some economic stimulus payments. They’re still trying to work their way through it. So what does that mean for people’s refunds? Are those going to be late as well?

TIM SPEISS: Early I would tell you because– not that we’ve had many clients, and I think this is probably true across the board, filing and getting refunds back. The IRS was fairly good with the stimulus payments last year and in 2020 as well. And also with correspondence and fulfilling refund requests where or they’ve been requested.

The service is challenged though, like many businesses are, in the context of workflow and turning things around. So I think it would be practical to expect some delays in refunds. And of course, the best way to accelerate a income tax refund, unless you’re applying it, is to file early. Early in the tax, year tax season, the IRS is not necessarily as inundated.

Anyone that can be filing in the next two or three weeks or so, probably should do it, if they don’t have a terribly complicated tax filing. Others are unable to. They have K-1s, more sophisticated 10-99 reporting, capital gains and losses. And it’s difficult to file earlier. But filing as soon as possible, if you’re in a refund position, is certainly optimal.

– All right, Tim Speiss of EisnerAmper, thanks for your time today.