Year-Round Tax-Saving Strategies to Lower Your 1040 Taxes

Saving money on taxes isn’t just for tax season—it requires year-round planning. Here are proactive strategies to help you lower your 1040 tax bill and maximize deductions throughout the year.

1. Adjust Your Tax Withholding Early in the Year

✅ If you received a large tax refund, you’re overpaying taxes throughout the year.

✅ If you owed taxes, you may need to increase withholdings or make estimated payments.

✅ Use IRS Form W-4 to adjust your withholdings at work.

🔗 Related: Understanding Your 1040 Tax Return

2. Max Out Retirement Contributions

✅ 401(k) contributions reduce taxable income—limit for 2024 is $23,000 ($30,500 if 50+).

✅ Traditional IRA contributions are tax-deductible—limit is $7,000 ($8,000 if 50+).

✅ Self-employed? Consider a Solo 401(k) or SEP IRA.

🔗 Related: How 2025 Contributions to IRA & 401(k) Can Reduce 2024 Taxes

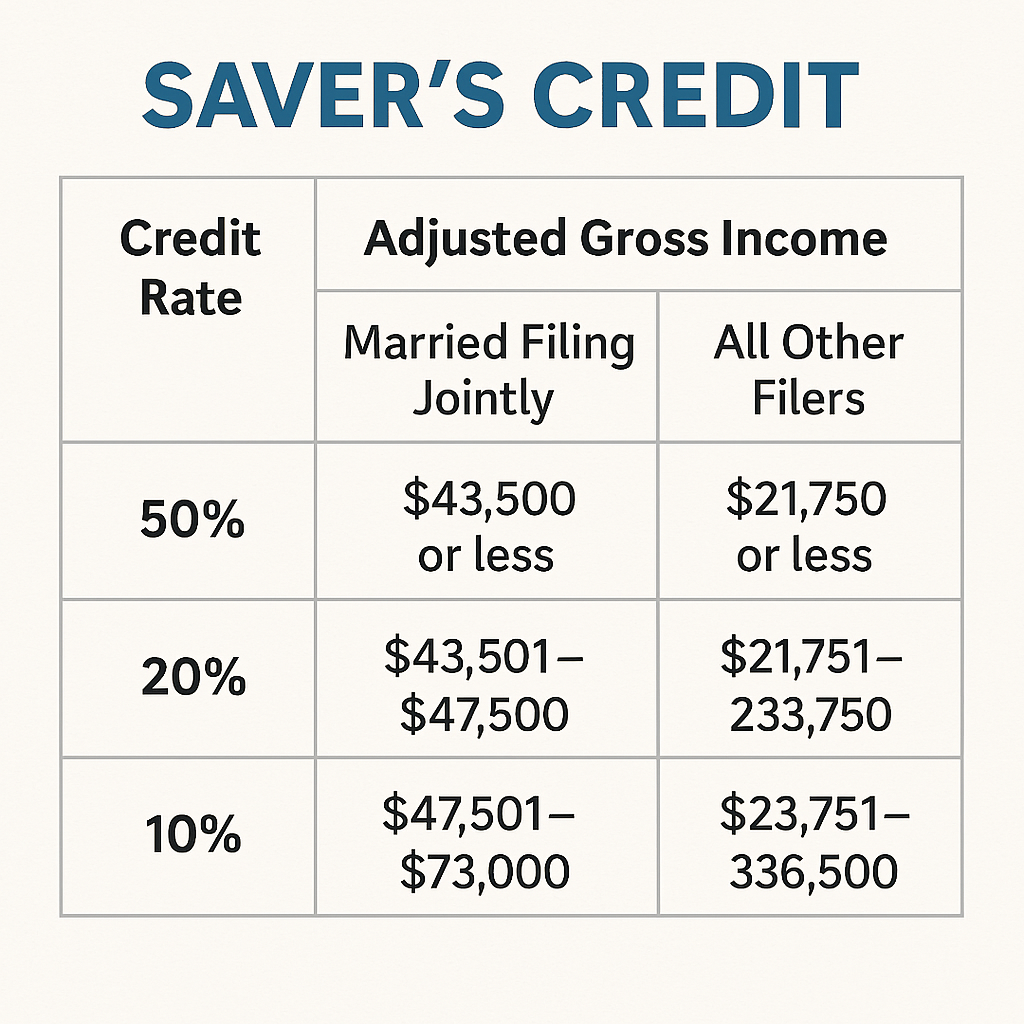

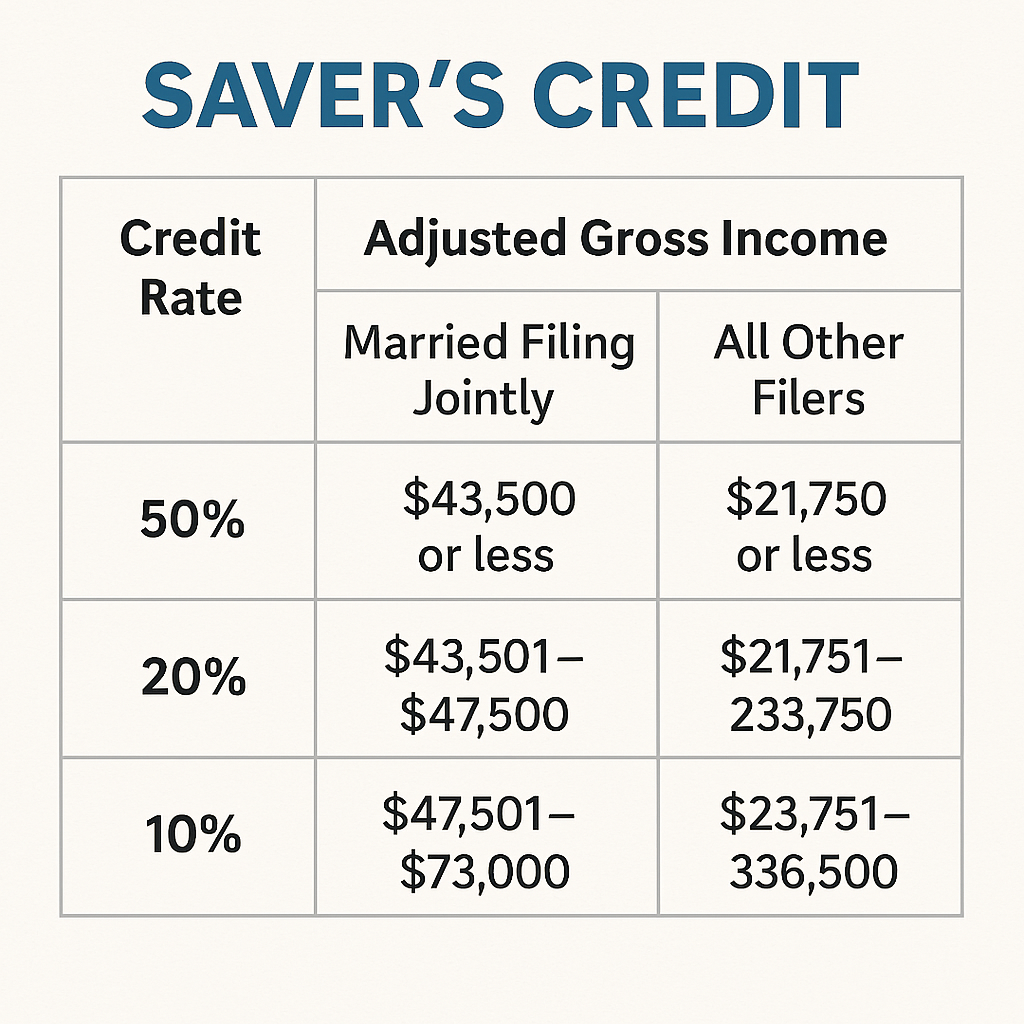

3. Take Advantage of Tax Credits

✅ Earned Income Tax Credit (EITC) – Available to low-to-moderate income taxpayers.

✅ Child Tax Credit (CTC) – Up to $2,000 per child.

✅ Saver’s Credit – For contributing to retirement accounts.

🔗 Related: Your Guide to Tax Credits & Deductions

4. Track and Deduct Work-Related Expenses

✅ Self-employed? Deduct business expenses like home office, internet, and vehicle costs.

✅ Employees working remotely? Check if you qualify for home office deductions.

✅ Freelancers and side hustlers should keep receipts and mileage logs.

🔗 Related: How Small Business Owners Can Reduce Their Tax Burden

5. Contribute to a Health Savings Account (HSA) or Flexible Spending Account (FSA)

✅ HSA contributions are tax-deductible, grow tax-free, and withdrawals for medical expenses are tax-free.

✅ FSA funds are pre-tax but must be used within the year.

🔗 Related: The Health Savings Account (HSA): A Triple Tax Advantage

6. Harvest Capital Losses to Offset Gains

✅ Sell underperforming stocks to offset capital gains taxes.

✅ Can offset up to $3,000 in ordinary income per year.

🔗 Related: IRS Tax Law Changes for 2025

Final Thoughts

Lowering your tax bill requires planning all year long. Take advantage of deductions, credits, and tax-saving investments to keep more of your money.

🚀 Next Steps:

- Adjust your tax withholding today.

- Contribute to retirement and HSA accounts.

- Keep organized records of expenses and deductions.

🔗 Need more tax guidance? Visit our Tax-Saving Blog & Expert Insights.