Editor’s note: Seeking Alpha is proud to welcome LDV Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Ingus Kruklitis/iStock via Getty Images

Recent quarterly results and outlook from competitor Enphase Energy (ENPH) has led to some weakness in the SolarEdge Technologies (NASDAQ:SEDG) share price recently. Investors are concerned about new regulations in California and the impact that prevailing macroeconomic conditions such as interest rates and disposable income will have on solar demand.

While the 1Q23 SolarEdge result also displayed weakness in its US market, Europe is currently making up for it, which is a much bigger segment proportionally compared to Enphase.

Some of the uncertainty in the US is related to NEM 3.0, which may actually present an opportunity to investors willing to believe that this new regulation actually represents a long-term opportunity rather than a short-term threat to US earnings. I’ll explain why in this article.

While still no bargain, the gap between valuation and share price has closed dramatically in the last couple of years and is perhaps the most attractive it has been for some time. However, there is evidence to suggest that SolarEdge could produce earnings stronger than what is currently forecasted by consensus due to continued momentum in Europe and a better-than-expected impact from changing regulations in the US, this may be enough to tip the scales to a buy.

A quick recap of 2022

2022 was an astounding year for SolarEdge. Revenue for the year increased by 58% over 2021, which was an acceleration of growth compared to the prior year’s growth over 2020 of a still impressive 35%.

While the Russia-Ukraine war was the Achilles heel of many high-flying technology stocks, it energized the momentum of SolarEdge (pun intended). The shift to renewable energy might have been underway for some years now already, but the energy crisis in Europe through 2022 showed the continent how dependent they were on external sources of energy and what a risk this was to their economies. Companies and individuals across Europe have been mobilized to seek energy independence to ensure they control their own destiny with respect to keeping the lights on and powering their factories, rather than relying on foreign, potentially hostile regions. Solar has been a major beneficiary of this thematic.

This was a key driver of momentum for SolarEdge with Europe revenues growing a whopping 89% in 2022, compared to the United States’ growth of 44%. This took Europe revenue contribution from 45% to 54% from 2021 to 2022, making Europe its biggest market. In the 1Q23 result, the contribution from Europe grew again to 62.5% of total Group revenues.

In 2023, this momentum is likely to continue with SEDG reporting Europe’s 1Q23 revenues more than doubling over the corresponding 1Q22 period. The Rest of World segment is also likely to contribute meaningfully, which was up 30% over 1Q22, with energy security a key theme in that segment as well, especially in South Africa, which experiences regular power outages due to an unstable grid.

NEM 3.0 could be a tailwind for SolarEdge

NEM stands for net energy metering. It means that solar owners who produce more energy than they need are able to sell this excess power back to the grid in the form of energy credits. Specifically, NEM 3.0 is the third iteration of net energy metering legislation in California and came into effect in April 2023. It changes the rate that solar owners in California will receive for this excess energy they export to the grid and also charges a connection fee to the grid for new solar users. SolarEdge have estimated this reduction at around 70%.

This may sound like a disincentive to install solar in California, a key state for SolarEdge, however, it does increase the attractiveness of installing a solar-plus-battery system, as your excess energy can be stored, rather than sold at a discount, allowing the owner to utilise the energy later (say, at night) or sell to the grid at peak times when the electricity price is at its highest. This would prevent owners from needing to buy energy from the grid when the sun isn’t shining instead of selling the energy for 25 cents on the dollar.

In my view, a battery greatly enhances the value of a solar energy system anyway and this shift in legislation could be the catalyst that tips the decision in favour of adding a battery for new users. So rather than negatively impact demand for solar inverter systems, the demand for solar panels and inverters may remain constant while the demand for attached batteries increases. This could be great news for SolarEdge, who have been rolling out a battery product of their very own, having launched the 10kW single-phase SolarEdge Home Battery in 2021 and the 5 kW three-phase Home Battery in 2022. The attach rate of batteries is still quite low, and the percentage of batteries that are SolarEdge are lower still, so any uptick in battery attach rate could be meaningful.

These products should assist organic revenue growth as it is, but it is perfect timing for a regulatory shift that could also increase demand for solar batteries. In fact, the Enphase Energy (ENPH) CEO, Badri Kothandaraman, said just that on their recent 1Q23 results call:

“We think our battery is going to be perfect for NEM 3.0, because the increased power of the battery will give the ability to export more energy during the time when the grid needs it in August and September and people can get paid handsomely for it. And because of that, you see the payback for a solar-plus-storage system under NEM 3.0 is approximately 6 to 8 years depending on which utility you are in. So, we think NEM 3.0 will accelerate the attach rate of batteries. And it might take a little bit of time for the industry and for the consumers to realize it, but I have no hesitation that NEM 3.0 will be better for California.”

– Badri Kothandaraman, ENPH President and CEO, 1Q23 conference call

Yes, those comments are somewhat specific to Enphase, but the broad theme is incredibly upbeat on a regulatory shift that has been viewed with caution. Rather than offering a 1:1 energy credit for exported energy, NEM 3.0 will offer 576 possible rates depending on the time of day, week, or year. Some of these rates will be higher than the retail rate, as confirmed by the SolarEdge CEO, Zvi Lando, on their 4Q22 results call, who echoed the sentiments of Kothandaraman:

“Under the new NEM 3.0 tariffs, average export rates dropped by approximately 70% compared to the current policy. But this number is a bit misleading as there are times in the year and specific days where the export rates are actually higher than they were under NEM 2.0. This will make coupling of solar PV with a battery a more attractive proposition for California homeowners, especially if the battery is smartly used to import and export power at the right times.”

– Zvi Lando, SEDG CEO, 4Q22 conference call

Indeed, this is a key selling point of SolarEdge Batteries, with this exact fact on the header of the SolarEdge Storage and Backup sales page.

Source: Solaredge.com

The ability to choose when to export power to the grid when prices are high is incredibly attractive to prospective solar customers.

The risk here is that this is just wishful thinking. ENPH has already noted that demand has been softer than expected in the USA, despite growth of 25% over the fourth quarter in Europe being, in my view more than adequate. However, the “NEM 2.0 rush”, as Kothandaraman put it, referring the increased demand to install solar systems prior to NEM 3.0 coming into effect, suggests the NEM 3.0 is being viewed negatively by the market.

In comments made on the 1Q23 ENPH conference call, Kothandaraman, at least, believes this to be temporary, with installers in California focusing on solar over batteries at present, a trend which they expect to continue for 3-4 months. He then reiterated:

After that, we see NEM 3.0 as a net positive for California, and expect strong demand to resume for solar-plus-storage.

– Badri Kothandaraman, ENPH President and CEO, 1Q23 conference call

Again, these comments are echoed by Lando in SolarEdge’s 1Q23 conference call. Lando spent some time expanding on his 4Q22 comments regarding NEM 3.0, re-emphasising the benefit consumers will have in adding a battery to their system. He said:

It is to the system’s owner’s advantage to use their energy the solar system produces during most times of the day other than in specific instances when the utility pays an exceptionally high rate for the tower exported from the system… Our analysis shows that the best return on investment under NEM 3.0 is achieved with a solar plus battery combination.

Further, in answering a question on battery attach rates, Lando said:

In the U.S., the attach rate are growing — let’s put it, growing very slowly…And for the reasons that I mentioned during the comments before, we expect the attach rates to gradually increase in the next quarters.

– Zvi Lando, SEDG CEO, 1Q23 conference call

The factors referred are both a strategic repricing of the batteries and the incentive and opportunity NEM 3.0 will provide for adding a battery, as discussed above.

So right here we have two companies in the same industry whose earnings are being negatively impacted by the same industry uncertainty. And both are pointing to the same regulation arguing that it will benefit their company in the coming quarters.

Inflation Reduction Act

The Inflation Reduction Act (IRA) was signed into law in 2022. Much has been written about the IRA so I won’t labour the point again here, but it does tie in nicely to the above discussion. In short, the IRA will provide incentives in the form of tax credits to residential and commercial solar customers, thus increasing demand for solar products. Combined with the ability to reduce reliance on the grid further via a battery and the potential for selling excess energy to the grid from this battery when prices are high, this could be a very powerful incentive.

Financial Forecasts

For all this talk about tailwinds, consensus has SEDG doing 32.5% revenue growth and 53% in adjusted EPS growth in 2023. (I am comfortable using adjusted as this mainly strips out the impairment announced in the 4Q22). This is a return to the still very strong growth report in the 2021 year and to some degree represents the law of large numbers.

FactSet consensus expects a 5 year revenue CAGR of 17% to 2027 and adjusted EPS CAGR of 25%.

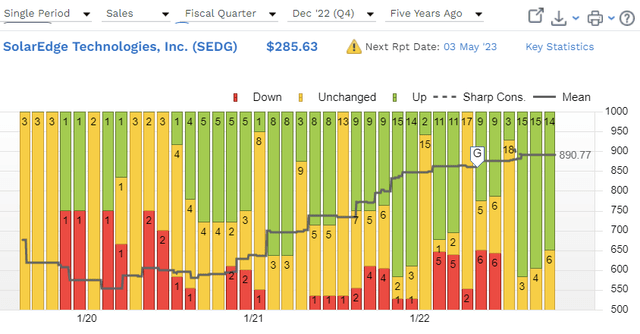

It should be noted that consensus has a history of underestimating sales figures. For each of the 3 years leading up to the December quarter for 2020, 2021, and 2022, consensus progressively upgraded their expectations as the period grew nearer and the picture became clearer. This is charted nicely by FactSet in the below chart for the December 2022 quarter. The squiggly line is the changing sales estimate.

This trend is already in play for the 2023 December quarter and the 2024 December quarter with sharp revisions upwards post the 1Q23 result. I think it is likely that this trend continues as SolarEdge continues their leadership, continues investing in their products, and brings new products (such as the recently released Home Battery) to market, expanding their serviceable addressable market.

Margin expansion will certainly help as well. Margins were down in 2022 but rebounded healthily in 1Q23, largely due to factors such as higher shipping costs, supply constraints, and a weaker euro all reversing this quarter. Management specifically called out an expectation for operating leverage in their 1Q23 comments with their ability to meet demand and the mix of lower margin batteries being the two key determinants of meeting their 22% EBIT margin goals for 2023 and beyond.

This is perhaps the reason a stock like SEDG trades on a higher than market multiple: the expectation of upgrades further into the future than the current earnings can capture in a single figure and it feeds into my valuation with higher growth anticipated than the current consensus forecasts.

Valuation

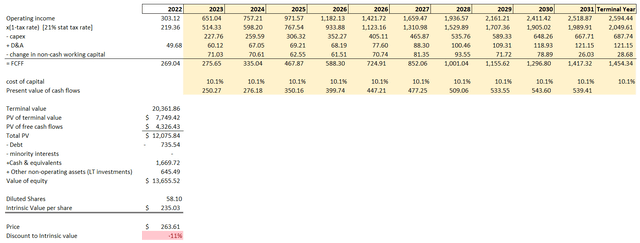

There is a long runway ahead of SolarEdge and I think it appropriate to use a 10 year DCF given both the growth potential and its likely ability to sustain earnings growth over this period. My assumptions and reasoning are as follows:

- 15.8% revenue growth CAGR from strong demand for SolarEdge’s leading products in an environment that is aggressively investing towards net zero carbon energy.

-

18.4% EPS growth over valuation period due to operating leverage, and

-

17% free cash flow CAGR based on the same reasoning.

-

Beta of 1.24 using peer set average, risk free rate of 4% using average long-term bond rates, and equity risk premium of 5.3% per Damodaran’s calculation.

-

Cost of debt 0.8% (note, company is net cash and borrowings are low compared to market cap).

-

The above gives a weighted average cost of capital of 10.1%.

-

Terminal growth rate of 3.0%.

The below image shows a simplified free cash flow to the firm (FCFF) DCF model out to 2031.

Author’s analysis using data from FactSet

The above assumptions produce a discounted cash flow valuation of $235, around 19% below the current share price ($292 at time of writing), providing very little margin of safety, but suggesting the stock is close to being fairly valued.

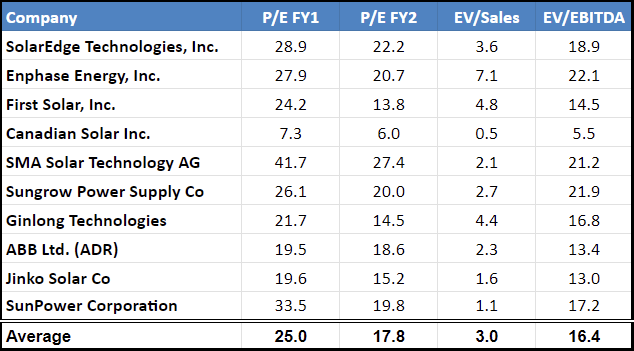

SolarEdge currently trades on a forward Price/Earnings multiple of 29x, a multiple not seen since mid-2020. This compares to SolarEdge’s industry peers, who trade on an average forward P/E of 25.0x, meaning that SolarEdge’s trades at a premium to its peer group. This, and several other relative multiples are shown in the table below:

Author’s representation based on data from FactSet

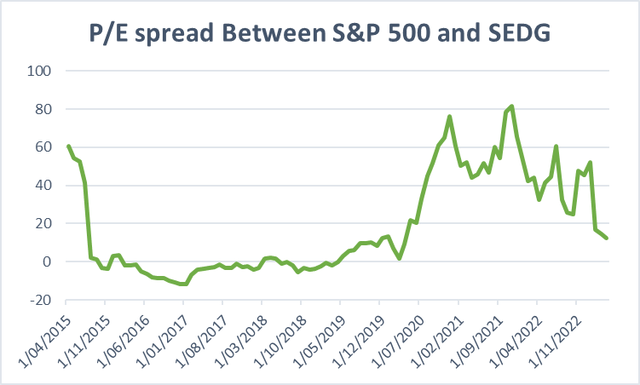

Further, the P/E premium of SEDG over the S&P 500 has not been above zero since before the pandemic. It is now still a hefty 12 points higher, but justifiably so, in my view, based on expected growth of SEDG compared to the S&P 500, and far lower than the 81 point spread it traded at in late 2021.

Author’s analysis based on data from FactSet

All that to say that on a P/E relative basis, 29x might seem high but is probably quite reasonable given the outlook for the company and the industry.

Risks to the Thesis

I think SolarEdge is a high quality company but not an infallible one. SolarEdge have been very successful in taking market share over the last decade but in reality, it is a highly competitive space and SEDG is not the only company with a good product. For example, Enphase Energy is another high quality company with their own proprietary solar inverter product that has helped them become a world leader as well, not to mention the products coming out of China at likely a lower price point. The cost of borrowing for consumers and businesses has also increased, which may have an impact on purchasing decisions, benefitting those with a cheaper, adequate product, reducing demand for SEDG products.

As discussed, there is a big future in solar and renewable energy and the leader today is not necessarily the leader tomorrow. Seeing SolarEdge’s growth slow while the growth of its competitors remained strong would be a major orange flag.

NEM 3.0 obviously also poses a risk. I have presented the bull case above, which is based on management commentary, but if the Battery Storage angle does not resonate with customers this will poke a massive hole in the thesis.

Any of the above scenarios would slow growth and reduce the valuation further and would each be cause for concern.

Conclusion

While I prefer a margin of safety in my valuations, sometimes you have to pay up for quality and SolarEdge may just be such a situation. SolarEdge is a high quality company that is growing strongly and is trading close to its fair value. At present, I rate it a strong hold, but expect volatility, and I would be looking for any opportunity to buy should the share price retrace closer to my valuation.