Offer in Compromise: Settle Your IRS Tax Debt for Less

If you’re struggling with tax debt, you may be able to settle with the IRS for less than what you owe through an Offer in Compromise (OIC). Here’s how the program works and how to see if you qualify.

What is an Offer in Compromise?

An Offer in Compromise (OIC) is an IRS program that allows qualifying taxpayers to settle their tax debt for less than the full amount owed. The IRS considers this option if you can prove that paying the full balance would cause financial hardship.

Who Qualifies for an Offer in Compromise?

To qualify, the IRS evaluates:

- Your ability to pay (income vs. necessary expenses).

- Your assets (equity in property, bank accounts, investments).

- Your total tax debt and financial hardship situation.

You may qualify if: ✅ You have no reasonable way to pay your full tax debt.

✅ You’re facing financial hardship (job loss, medical expenses, etc.).

✅ Your income and expenses show inability to pay the full balance.

🔗 Not sure if you qualify? Use the IRS Offer in Compromise Pre-Qualifier Tool.

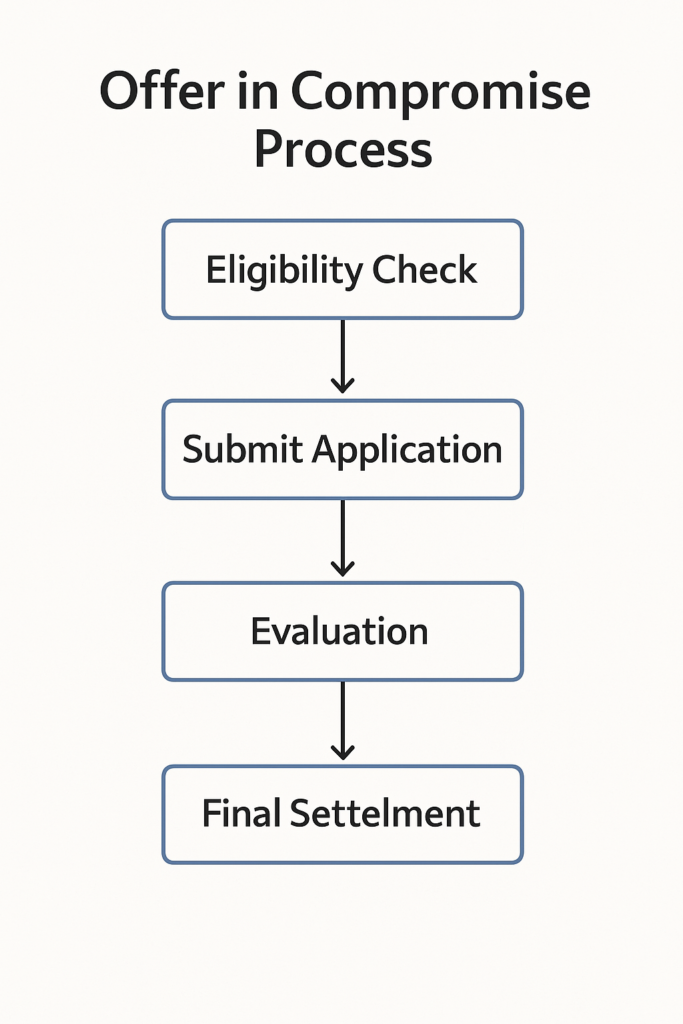

How to Apply for an Offer in Compromise

Step 1: Complete the Required Forms

You must submit: 📄 Form 656 – Offer in Compromise request.

📄 Form 433-A (OIC) – Financial disclosure for individuals (or Form 433-B for businesses).

💲 Application fee of $205 (waived for low-income applicants).

Step 2: Choose a Payment Option

You can submit your offer with: 1️⃣ Lump-Sum Payment – Pay 20% of the offer amount upfront, and the remaining balance upon IRS approval. 2️⃣ Monthly Payment Plan – Make payments while the IRS reviews your offer.

Step 3: Submit Your Application

- Mail your completed Form 656 package to the IRS.

- Wait 6 to 12 months for a response.

- Continue making payments (if applicable) while your offer is under review.

What Happens If Your Offer Is Accepted or Rejected?

✅ Accepted: You must pay the agreed amount and comply with all future tax filings. ❌ Rejected: You can appeal or explore other options like an IRS payment plan.

🔗 Need another option? Learn about IRS Payment Plans.

Pros & Cons of an Offer in Compromise

| Pros | Cons |

|---|---|

| Settle for less than what you owe | Strict eligibility requirements |

| Avoid IRS collection actions | Long review process (6-12 months) |

| Can remove tax liens | Must stay compliant for 5 years |

Final Thoughts

An Offer in Compromise can be a lifeline for taxpayers in financial distress. However, the IRS only approves offers when it believes it cannot reasonably collect the full amount.

🚀 Ready to explore your options? Start with our Filing & Paying Back Taxes Guide.