How to Request Your IRS Transcript

If you need to verify your tax records, apply for a loan, or check income reported to the IRS, requesting an IRS transcript is a quick and easy solution. Here’s how you can obtain yours.

What is an IRS Transcript?

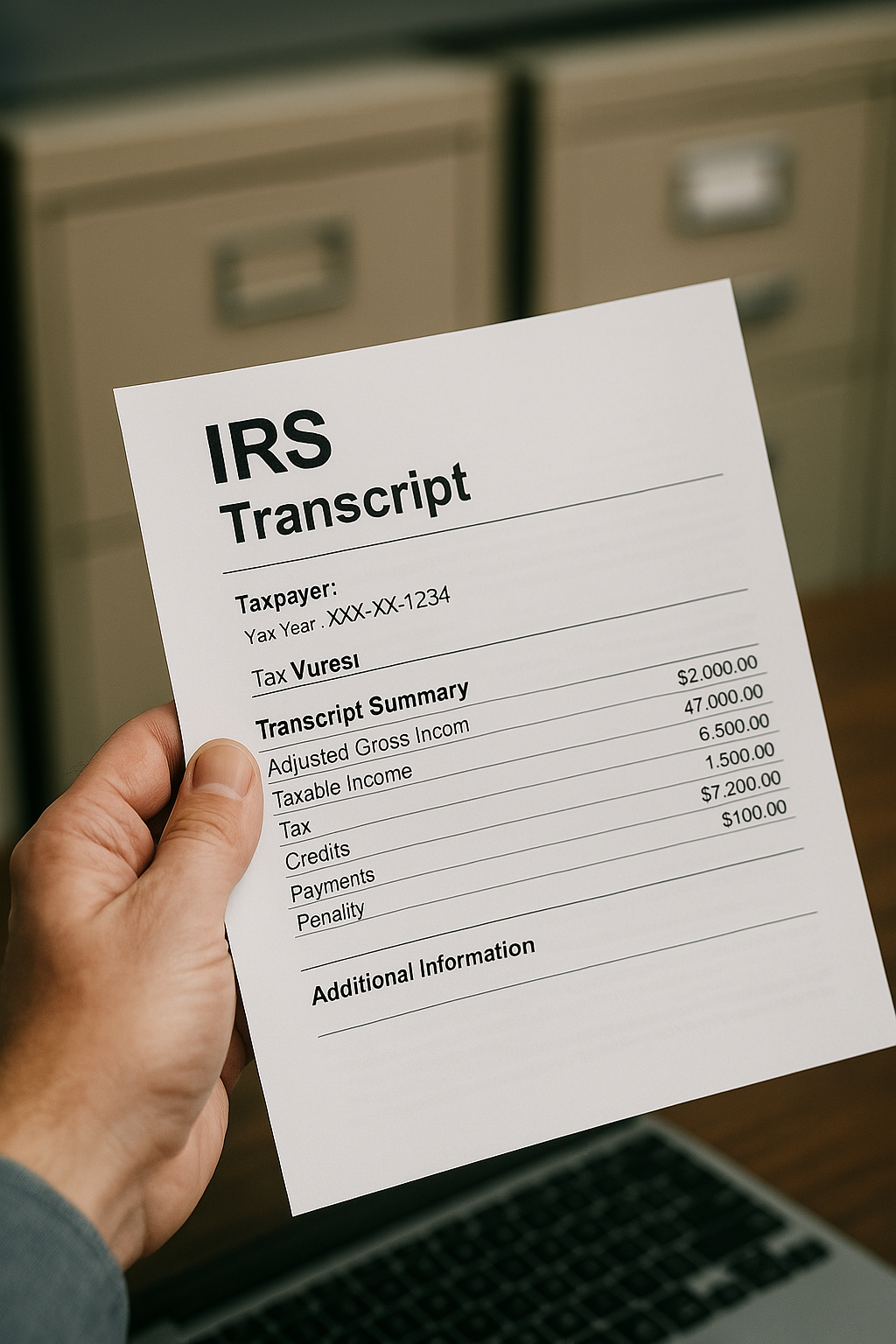

An IRS transcript is a summary of your tax return information. It is free to request and can be used to verify income, tax payments, or refund history. Common transcript types include:

- Tax Return Transcript – A summary of your filed tax return (most requested option).

- Tax Account Transcript – Includes basic data like return type and payment history.

- Wage & Income Transcript – Shows reported W-2s, 1099s, and other income statements.

- Record of Account Transcript – A full combination of return and account transcripts.

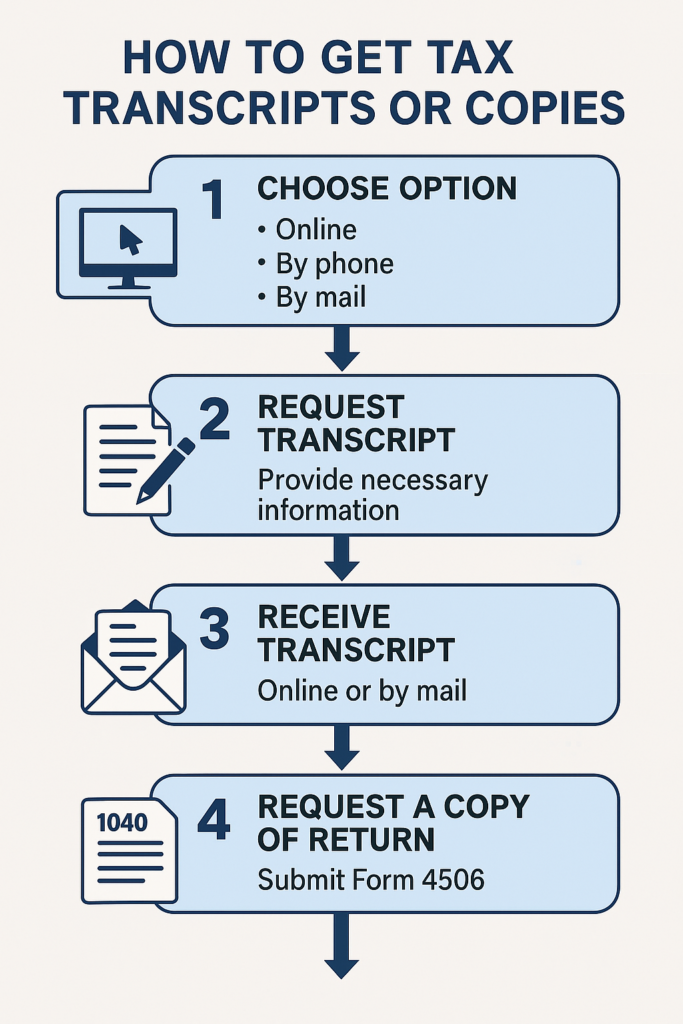

Ways to Request an IRS Transcript

1. Online (Fastest Method)

- Go to the IRS Get Transcript page.

- Select Get Transcript Online and log in or create an IRS account.

- Choose the transcript type and tax year you need.

- Download or print your transcript immediately.

2. By Mail

- Visit the Get Transcript page.

- Select Get Transcript by Mail and enter your personal details.

- The IRS will mail your transcript in 5–10 business days.

3. By Phone

- Call the IRS at 1-800-908-9946.

- Follow the prompts to request a transcript by mail.

4. By Paper Form (For Businesses & Older Records)

- Complete Form 4506-T (Request for Transcript of Tax Return).

- Mail or fax it to the IRS address listed on the form.

- Processing time takes about 10 days.

Why Would You Need an IRS Transcript?

- Verifying income for a mortgage, loan, or financial aid.

- Confirming tax payments if facing an audit or IRS dispute.

- Checking for errors or discrepancies in reported income.

- Recovering tax documents if you lost your tax return copy.

Need Help with Back Taxes?

If you’re behind on taxes or need to file old returns, check out our guide on How to Start Filing and Paying Back Taxes.

Final Tips

✅ Always request the correct transcript type for your needs.

✅ If you need a full copy of your tax return, file Form 4506 instead.

✅ Transcripts are available for up to 10 years of tax records.

For more details, visit the IRS Transcript Request Page.