lindsay_imagery

Thesis

When it comes to investing in gold, it is crucial to keep an eye on macroeconomic factors, particularly the US real interest rates, rather than solely focusing on gold’s fundamentals. Although 2022 was an exception, typically, there exists a strong negative correlation between US gold prices and the 10-year US TIPS yield.

The Federal Reserve’s primary responsibility is to combat inflation, and while their job is not yet complete, we have already seen the negative outcomes of excessively tight US monetary policy following the failure of some regional banks. Therefore, we anticipate that the Fed will likely reduce rates either by the end of this year (at the earliest) or in the first half of 2024.

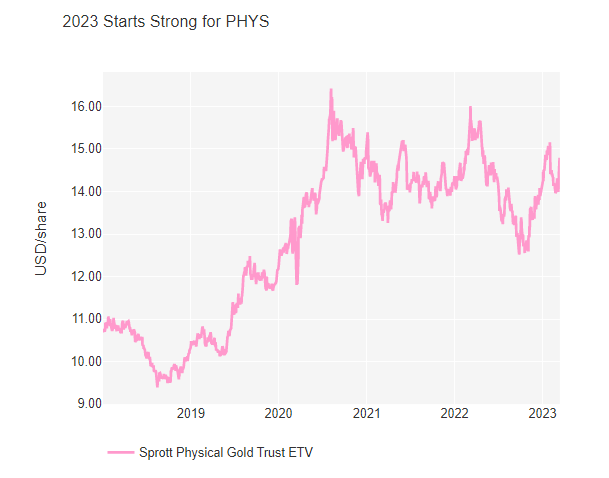

Since US real rates typically move ahead of cuts in the Fed funds rate (FFR), we believe investors should begin closely monitoring macro signals. This is because a buying opportunity for gold could be approaching. US investors may want to consider the Sprott Physical Gold Trust, which offers tax advantages and allows for exposure to gold.

Yahoo Finance

Sprott Physical Gold Trust

The Sprott Physical Gold Trust (NYSEARCA:PHYS, TSX:PHYS:CA) is a closed-end trust that offers investors a secure, convenient, and cost-effective means to gain exposure to physical gold. Sprott Asset Management LP manages the trust, which is designed to track the price of gold and provide a liquid investment option for those interested in investing in the precious metal.

The trust stores its gold holdings in fully allocated, segregated storage vaults, with the gold held in a London Good Delivery bar format. This approach ensures that the gold meets the quality requirements established by the London Bullion Market Association (LBMA).

The trust’s units are traded on major stock exchanges such as the Toronto Stock Exchange (TSX) and the New York Stock Exchange (NYSE) under the ticker symbols “PHYS” and “PHYS.U” respectively. This allows investors to conveniently buy and sell units of the trust through their brokerage accounts.

Tax advantages

Sprott Physical Gold Trust has a potential tax benefit for US investors because it is structured as a grantor trust, not an exchange-traded fund (ETF). This means that for US investors, the trust’s gains are treated as long-term capital gains, which are subject to a maximum tax rate of 20%, rather than the 28% tax rate typically applied to most precious metal ETFs. However, investors should seek advice from their tax advisors to fully understand the tax implications of investing in the trust, which may vary depending on their individual circumstances.

Expense Ratio

The Sprott Physical Gold Trust has an expense ratio of around 0.75%, which is relatively competitive compared to its competitors. Here are the expense ratios of some other popular gold investment options:

SPDR Gold Trust (GLD): 0.40%

iShares Gold Trust (IAU): 0.25%

Aberdeen Standard Physical Gold Shares ETF (SGOL): 0.17%

Although the Sprott Physical Gold Trust’s expense ratio is higher than some of its competitors, it is essential to consider the differences in trust structure and potential tax benefits, as mentioned previously. The Sprott Physical Gold Trust is structured as a grantor trust, whereas many other gold investment options are structured as ETFs. This difference may result in more favorable tax treatment for US investors in the Sprott Physical Gold Trust than in other gold investment options. However, individual investors should consult with their tax advisors to understand the specific tax implications based on their personal situations.

Outlook for gold

We hold a constructive view on gold prices over the next 12 months due to the impending US recession. Leading indicators, such as The Conference Board Leading Economic Index, and market-based indicators, such as the yield curve, suggest that the US economy is likely to enter a recession in the latter half of 2023. When this occurs, we anticipate the Fed will reduce rates. Prior to this, we expect US real rates to decline as the market will have already priced in the impending rate cuts by the Fed.

Although the relationship between US real rates and gold prices was disrupted somewhat in 2022, it has stabilized since the beginning of this year. We illustrate this relationship in the chart below, which shows PHYS on the left axis and the 10-year US TIPS yield in reverse on the right axis. The 10-year US TIPS yield is a proxy for US real interest rates. If this correlation persists in the coming quarters, a decrease in US real rates would naturally lead to an increase in gold prices.

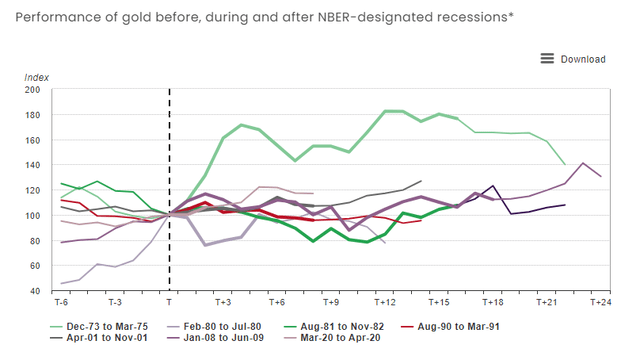

This reasoning is sound because gold prices generally perform well during recessions. The chart from the World Gold Council below demonstrates the performance of gold before, during, and after a US recession.

Additionally, geopolitical tensions and macroeconomic uncertainty should continue to prompt central banks to accumulate gold in their reserves.

Against this, we believe that macroeconomic uncertainty will intensify in the coming quarters, making it an opportune time to invest in gold through the Sprott Physical Gold Trust.

Conclusion

In conclusion, investing in gold can be a prudent strategy during times of economic uncertainty, and the Sprott Physical Gold Trust offers investors a secure, cost-effective, and tax-efficient means to gain exposure to physical gold. By closely monitoring macroeconomic factors such as US real interest rates, investors may be able to identify buying opportunities in gold, particularly in anticipation of a looming US recession. The potential tax benefits of the trust’s grantor structure may further enhance the attractiveness of investing in PHYS for US investors.