This story is part of Taxes 2023, CNET’s coverage of the best tax software, tax tips and everything else you need to file your return and track your refund.

It’s time to file your tax return, but before you do so, a major question lingers: Which work expenses can I deduct? The simplest answer is, it depends on the sort of work you do. The biggest deductions for work expenses are restricted to self-employed people and small business owners, but some full-time employees can get a few tax breaks too.

If you’re one of the many taxpayers who pivoted to remote work or started working for yourself, you can take advantage of a few deductions this tax season from the work expenses you incurred during 2022.

Learn which expenses you can deduct from your taxable income if you’re an employee or self-employed and how to claim them when you file your tax return this year.

For more, here are the best free tax filing options for 2023, why you should create an online IRS account before you file your taxes and how to track your tax refund.

Which work expenses can W-2 employees deduct from their taxes?

Unfortunately for W-2 employees, the Tax Cut and Jobs Act of 2017 eliminated almost all tax deductions for unreimbursed employee expenses.

Only a few specific types of W-2 employees can still claim work expenses:

- Reservists in the armed forces

- Qualified performing artists

- Fee-basis state or local government officials

- Employees with work expenses related to an impairment

Those eligible taxpayers can report and claim their unreimbursed work expenses using Form 2106, “Employee Business Expenses.” These expenses can include vehicle costs, travel costs, work clothes and meals, but the IRS has stringent rules for documentation — taxpayers must “prove the time, place, business purpose, business relationship (for gifts), and amounts of these expenses,” the instructions to the form explain. Receipts must be provided for all lodging expenses or for any work expense of $75 or greater.

Eligible educators working in kindergarten through 12th grade can also deduct some of their work expenses, including professional development and classroom supplies. Each eligible teacher can deduct up to $300 of unreimbursed expenses on line 11 of Form 1040 Schedule 1.

Eligible W-2 employees need to itemize to deduct work expenses

If you are an eligible W-2 employee, you can only deduct work expenses on your taxes if you decide to itemize your deductions. Your decision will depend on whether the total of your itemized deductions is greater than the standard deduction — $12,950 for single filers, $19,400 for head-of-household filers and $25,900 for married people filing a joint return.

Along with eligible work expenses, personal itemized deductions can include mortgage interest, retirement contributions, property taxes, charitable donations, medical expenses and student loan interest.

Most Americans choose the standard deduction when filing their taxes. It is a simpler route than itemizing your deductions, which requires further proof of expenses and receipts.

The IRS encourages taxpayers to itemize when your “allowable itemized deductions are greater than the standard deduction or you can’t use the standard deduction.”

Self-employed and business owners can deduct work expenses even if they take the standard deduction

If you’re self-employed or own a business, you can deduct business expenses on your taxes regardless of whether you take the standard deduction or itemize.

“Business expenses are known as above the line deductions which are available regardless of the choice to itemize. Consequently, a taxpayer could have substantial business expenses and still claim the standard deduction,” Eric Bronnenkant, CPA/CFP and Head of Tax at online financial advisor Betterment, told CNET in an email.

On Schedule C, freelancers and business owners will report their business income and work expenses. Bronnenkant said taxpayers should familiarize themselves with the form prior to filing.

“The IRS allows businesses to deduct ordinary and necessary business expenses. The key question: Was this an ordinary and necessary expense for the business activity? Notably, this excludes any personal expenses,” Bronnenkant said.

What is the home-office tax deduction and who can claim it?

The home office deduction is a major work expense deduction that self-employed people can claim. If you use your home office space for work purposes — and work purposes only — you may be eligible for the home office deduction.

The home office deduction has strict requirements you must follow to be eligible. First, you will need to be self-employed to take advantage of this deduction, meaning that you receive a 1099 form for self-employed workers and not a W-2 form for employees. Taxpayers must “exclusively and regularly” use a part of their home for work purposes, the IRS says. So your desk inside your bedroom doesn’t count, and remote employees working from home do not qualify.

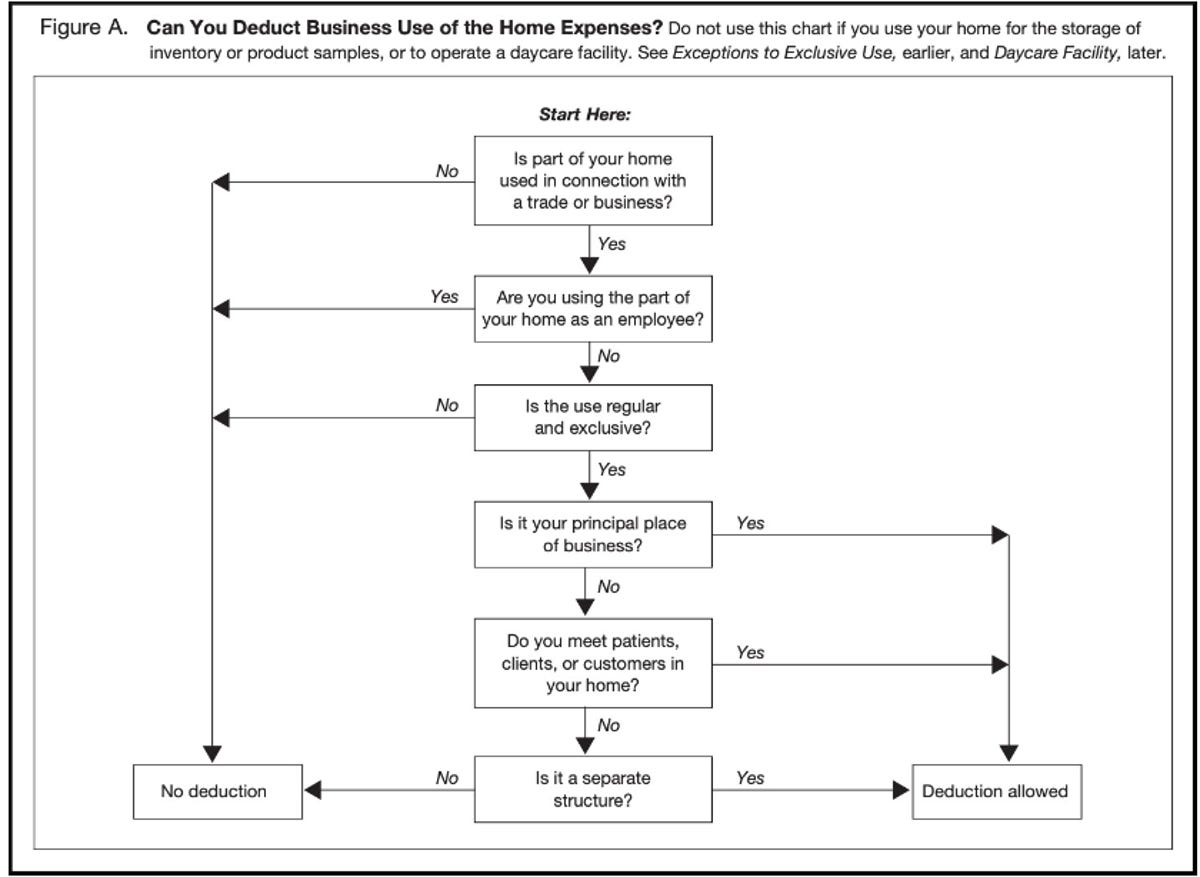

Use this chart to figure out whether your home expenses qualify for a deduction.

IRS

If you are eligible for the home-office deduction, there are two ways to calculate it. A simplified option introduced in 2013 lets taxpayers claim $5 per square foot of space used to a maximum of 300 square feet. The traditional “regular” method for claiming the deduction requires detailed records of all expenses.

To use the simplified method, you’ll complete the worksheet in Form 1040 Schedule C. For the regular method, you’ll need to complete and file Form 8829, “Expenses for Business Use of Your Home.”

How do I deduct the self-employment tax?

Self-employed workers may get substantial tax breaks like the home office deduction, but they also pay a hefty federal tax of 15.3% on their income. This self-employment tax is comparable to the Social Security and Medicare taxes that companies pay for employees.

Even if you are an employee of a company, if you earn more than $400 on freelance work you must pay self-employment tax on that income. The self-employment tax generally applies to 92.35% of your net income as determined on Schedule C.

The good news for self-employed taxpayers is that half of the self-employment tax is deductible. After you calculate the self-employment taxes that you owe using Schedule SE, you’ll take 50% of it and enter the deduction on line 15 of Form 1040.

Can I deduct health care premiums if I’m self-employed?

Yes, you can. If you work for yourself and weren’t eligible for an employer-provided health care plan in 2022, you can likely claim the cost of your health insurance premiums as an above-the-line deduction. That means you don’t need to itemize personal deductions to claim it.

These premiums can include medical, dental and qualifying long-term care insurance. You can claim them for yourself, a spouse or any dependents.

You can only claim insurance premiums up to the amount of business income that you earned in 2022. If your business didn’t make any money, you can’t claim any deduction.

Your deductions for long-term care insurance are limited by your age. Here are the deduction limits for 2022:

2022 Deduction Limits

| Taxpayer age | Long-term care premium limit |

|---|---|

| 40 or younger | $450 |

| 41 to 50 years old | $850 |

| 51 to 60 years old | $1,690 |

| 61 to 70 years old | $4,510 |

| 71 and older | $5,640 |

To take the self-employed health insurance premium deduction, you’ll enter the total amount you are claiming as an adjustment to income in Part II of Form 1040 Schedule 1.

What is the qualified business income deduction?

In addition to deducting business expenses, many freelancers, business owners and business partners can take advantage of the qualified business income deduction, Bronnenkant said. It allows business owners to deduct up to 20% of qualified business income plus 20% of qualified real estate investment trust dividends and qualified publicly traded partnership income.

To be eligible for the QBI deduction, you must either be a sole proprietor (including freelancers) or receive “pass-through” income from an S corporation, partnership or limited liability corporation (LLC). You can take the full QBI deduction if your income is less than $170,050 for single filers or $340,100 for joint filers. Higher incomes can claim a partial deduction using a complicated system that takes into account the type of business involved, property owned by the business and total wages paid to employees.