How to Claim the Saver’s Credit for Retirement Contributions

The Saver’s Credit is an overlooked tax benefit that rewards low- and moderate-income taxpayers for saving for retirement. This credit directly reduces your tax bill, making it easier to build long-term wealth while lowering your 1040 taxes.

1. What Is the Saver’s Credit?

✅ A tax credit worth up to $1,000 ($2,000 for married couples).

✅ Applies to 401(k), 403(b), IRA, and some other retirement contributions.

✅ Helps lower-income taxpayers offset the cost of saving for retirement.

🔗 Related: How Retirement Contributions Can Reduce Your 1040 Taxes

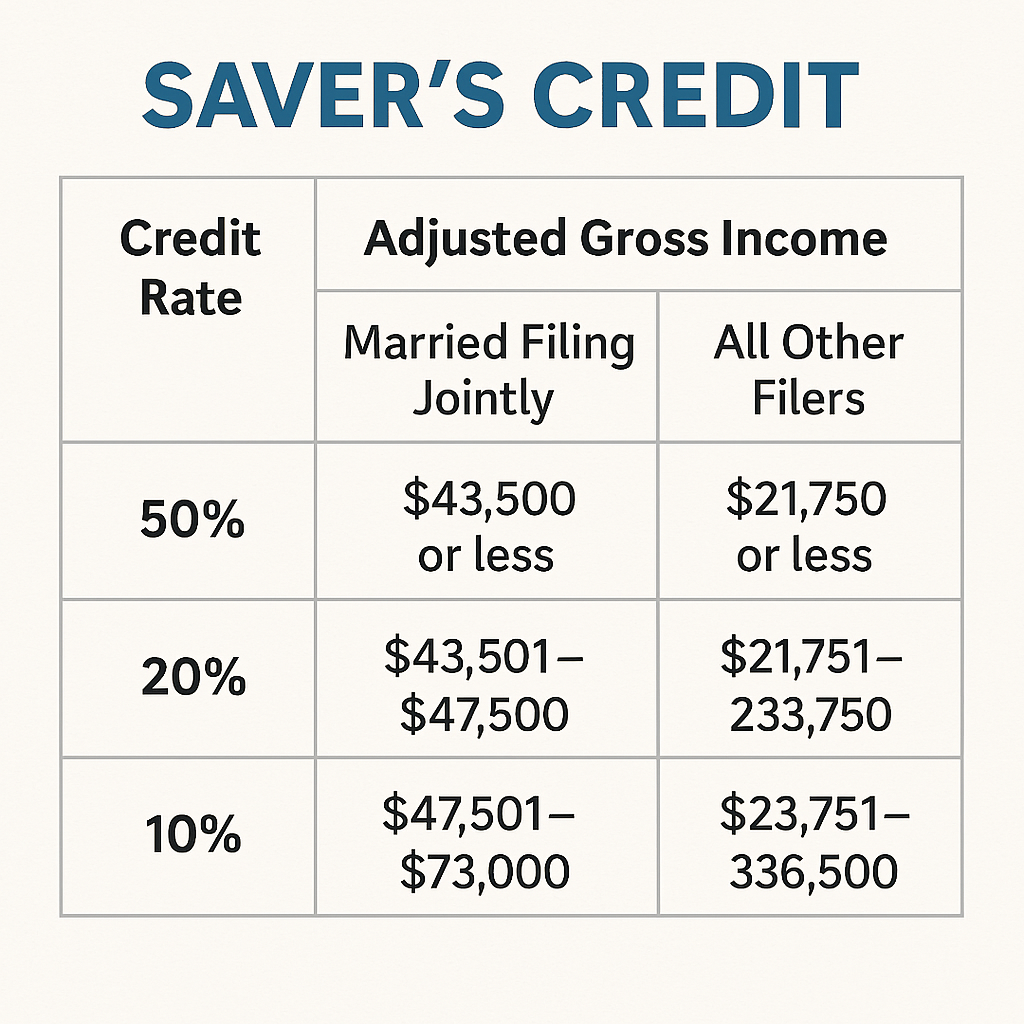

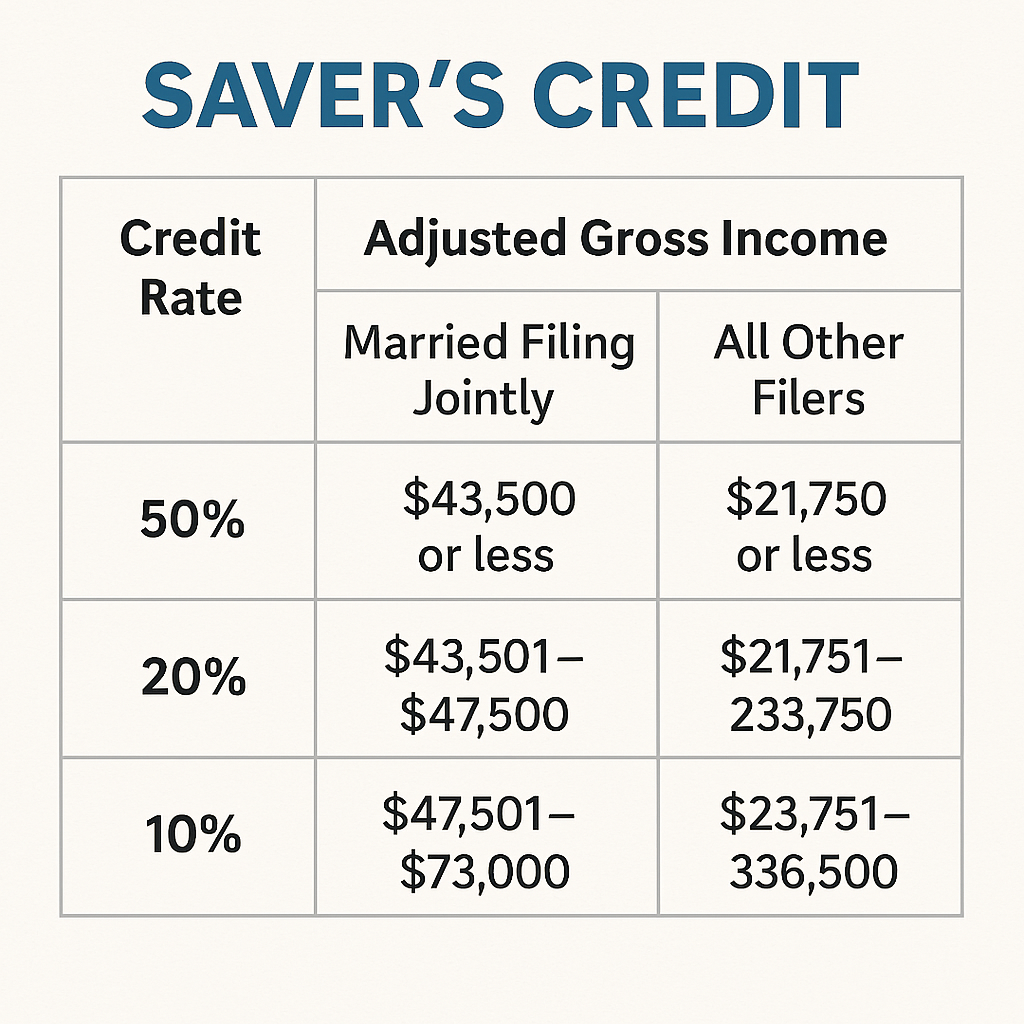

2. Saver’s Credit Income Limits (2024)

| Filing Status | 50% Credit (Max) | 20% Credit | 10% Credit | Not Eligible Above |

|---|---|---|---|---|

| Single | $0 – $23,000 | $23,001 – $25,000 | $25,001 – $36,500 | $36,501+ |

| Married Filing Jointly | $0 – $46,000 | $46,001 – $50,000 | $50,001 – $73,000 | $73,001+ |

| Head of Household | $0 – $34,500 | $34,501 – $37,500 | $37,501 – $54,750 | $54,751+ |

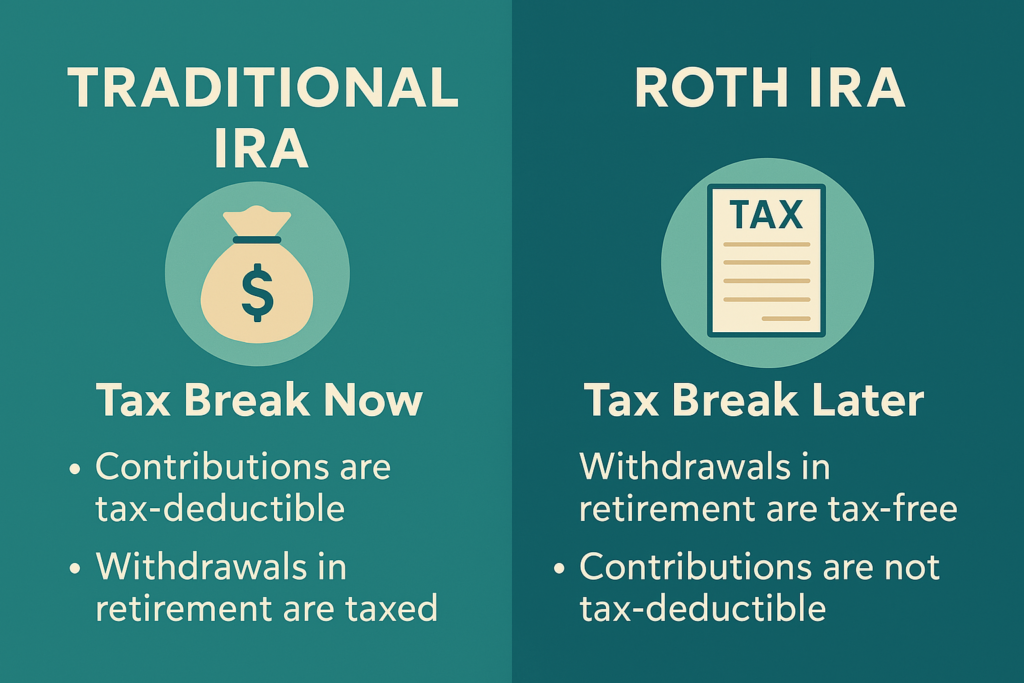

🔗 Related: Traditional vs. Roth IRA: Which One Lowers Your Taxes More?

3. Who Qualifies for the Saver’s Credit?

✅ Must be 18 or older and not a full-time student.

✅ Cannot be claimed as a dependent on someone else’s tax return.

✅ Must contribute to a qualified retirement account.

🔗 Related: Self-Employed Retirement Plans: SEP IRA, Solo 401(k), & More

4. How Much Can You Get?

The credit is worth 50%, 20%, or 10% of your contributions, depending on income.

✅ Maximum Contribution for Credit:

- $2,000 per person ($4,000 for married couples filing jointly).

- Couples could receive up to $2,000 in total tax savings.

🔗 Related: How 2025 Contributions to IRA & 401(k) Can Reduce 2024 Taxes

5. How to Claim the Saver’s Credit

✅ File Form 8880 (Credit for Qualified Retirement Savings Contributions).

✅ Report IRA, 401(k), or 403(b) contributions on your 1040 tax return.

✅ Use tax software or a preparer to calculate the credit.

🔗 Related: The Health Savings Account (HSA): A Triple Tax Advantage

Final Thoughts

The Saver’s Credit is a valuable tax break for those saving for retirement. If you qualify, it’s like getting free money for your future while lowering your tax bill today.

🚀 Next Steps:

- Check if your income qualifies for the Saver’s Credit.

- Make 401(k), IRA, or 403(b) contributions before the tax deadline.

- File Form 8880 to claim your credit.

🔗 Need more tax-saving strategies? Visit our Retirement Tax Savings Guide.