Understanding Your 1040 Tax Return: A Line-by-Line Breakdown

Your Form 1040 is the central tax document used for filing your federal income tax return. Understanding each section helps you file accurately, avoid mistakes, and maximize tax benefits.

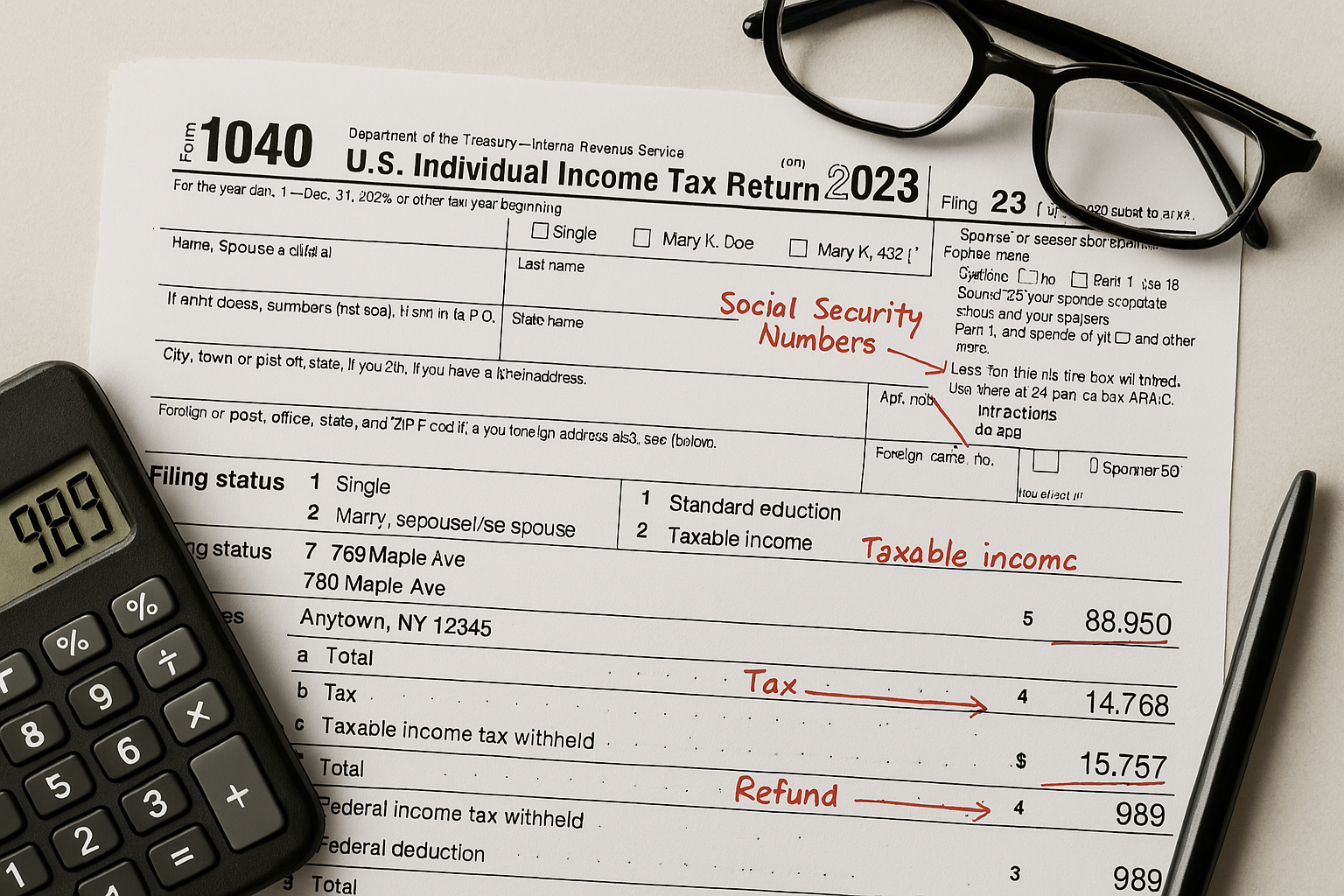

1. Personal Information & Filing Status

📌 Lines 1-5: Enter your name, Social Security Number (SSN), and filing status (Single, Married Filing Jointly, Head of Household, etc.).

✅ Your filing status determines your tax bracket and eligibility for credits.

🔗 Related: What Documents Do You Need to File Your Taxes?

2. Income Section (Lines 6-11)

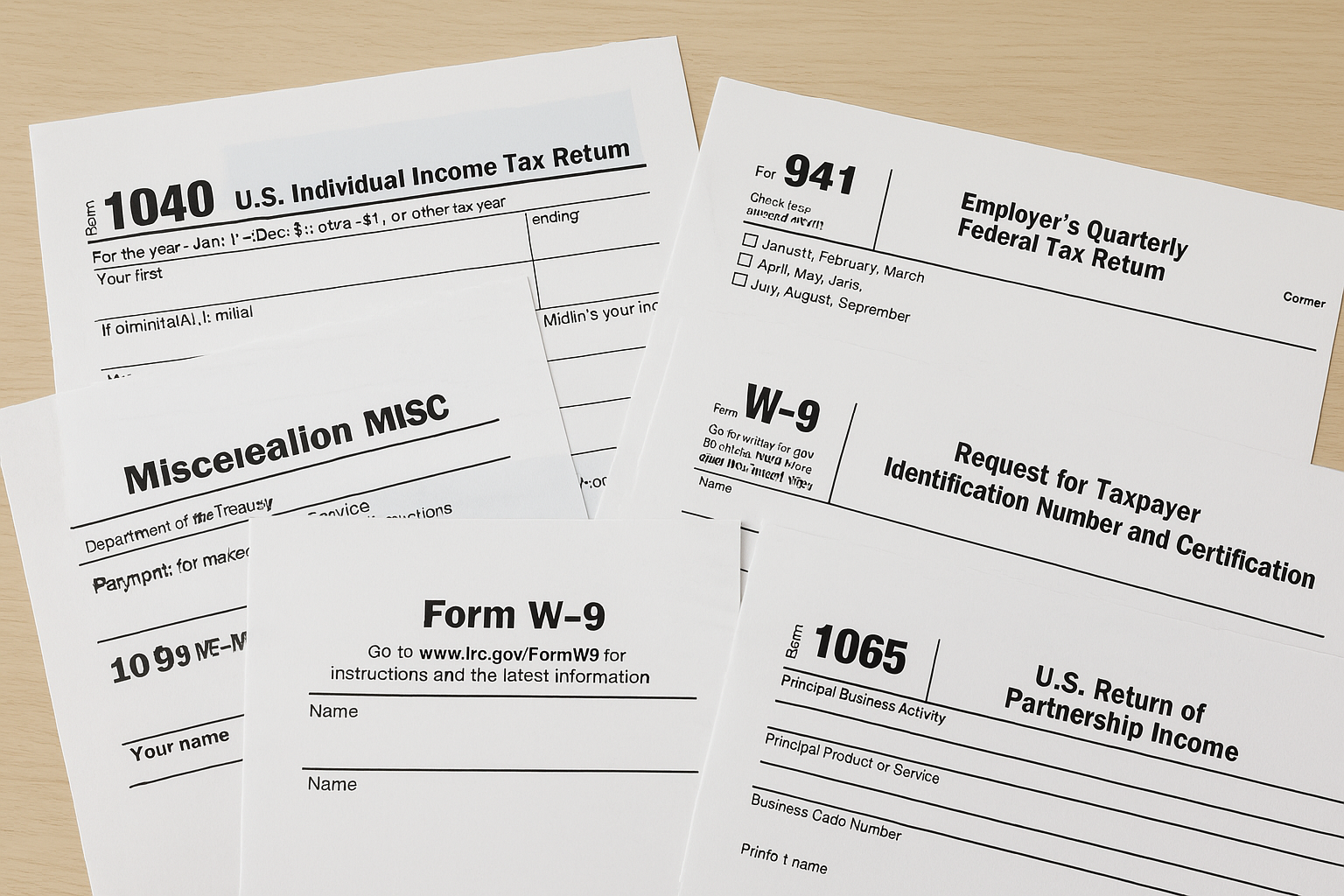

📌 Report wages, salaries, tips (W-2), self-employment income (1099-NEC), investment income (1099-DIV, 1099-INT), Social Security benefits, and rental income.

✅ If self-employed, make sure to deduct business expenses to lower taxable income.

🔗 Related: IRS Forms & Where to Find Them

3. Adjustments to Income (Lines 12-15)

📌 This section allows you to claim deductions that lower your Adjusted Gross Income (AGI), such as: ✅ IRA contributions ✅ Student loan interest ✅ Health Savings Account (HSA) deductions

🔗 Related: How 2025 Contributions to IRA & 401(k) Can Reduce 2024 Taxes

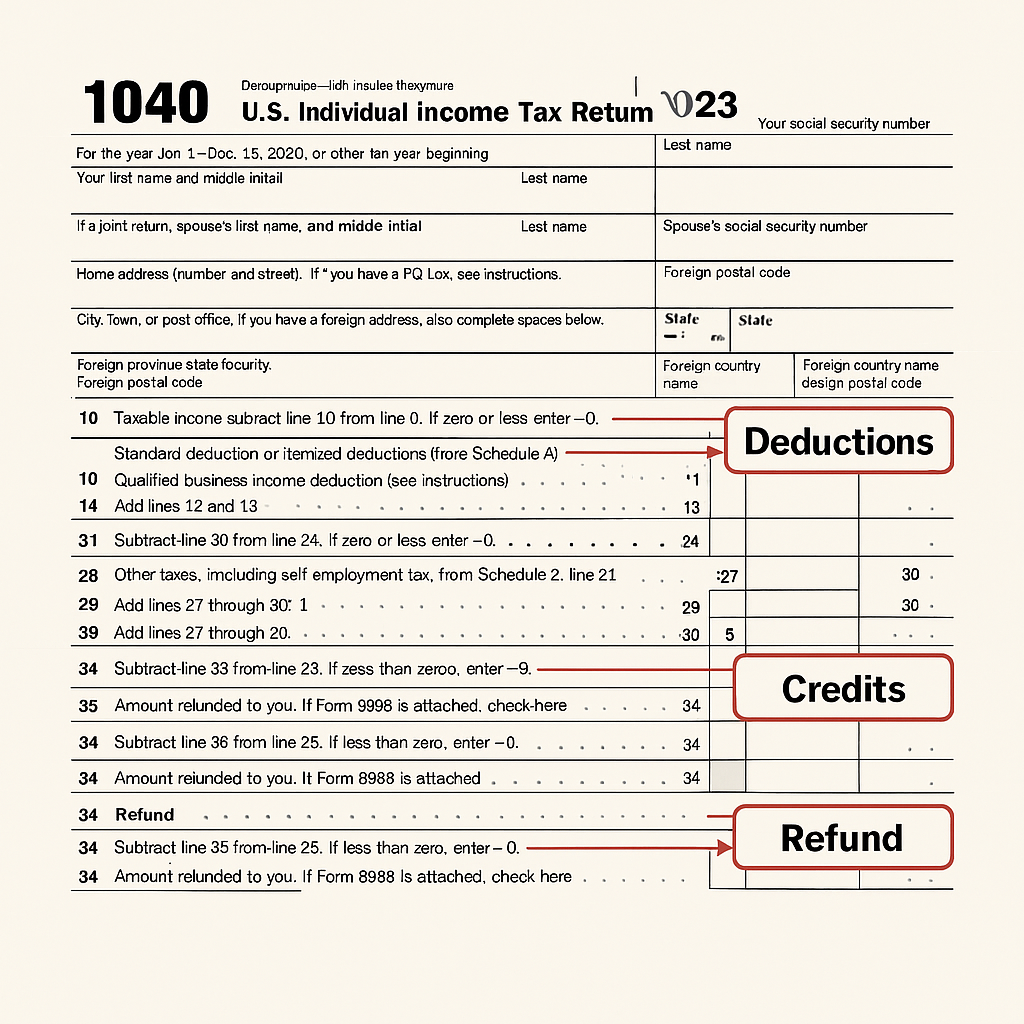

4. Standard Deduction vs. Itemized Deductions (Lines 16-18)

📌 Choose either the Standard Deduction or Itemized Deductions. ✅ Standard Deduction (2024): $13,850 (Single), $27,700 (Married Filing Jointly) ✅ Itemized Deductions: Mortgage interest, medical expenses, charitable donations

🔗 Related: Your Guide to Tax Credits & Deductions

5. Tax Credits & Payments (Lines 19-33)

📌 Common tax credits that reduce your tax bill dollar-for-dollar: ✅ Child Tax Credit (CTC) – Up to $2,000 per child ✅ Earned Income Tax Credit (EITC) – Up to $7,430 for low-income workers ✅ Saver’s Credit – For retirement contributions

🔗 Related: Top 10 Frequently Asked Tax Questions

6. Refund or Amount Owed (Lines 34-37)

📌 Line 34: Refund amount (if overpaid taxes).

📌 Line 37: Amount owed (if you underpaid taxes).

✅ To avoid underpayment penalties, adjust your W-4 withholdings or estimated tax payments.

🔗 Related: How to Check Your IRS Refund Status

Final Thoughts

Understanding Form 1040 helps you file taxes correctly, claim maximum deductions and credits, and avoid IRS issues. Whether you’re filing yourself or using software, knowing each section’s purpose ensures accuracy.

🚀 Next Steps:

- Gather all tax documents before filing.

- Choose between the standard deduction or itemized deductions.

- Use tax software to ensure correct calculations.

🔗 Need more tax guidance? Visit our Tax Resource Hub.