Who Qualifies for the Child Tax Credit?

The Child Tax Credit (CTC) can provide significant tax savings for families with dependent children. Here’s how it works, who qualifies, and how to claim it.

How Much Is the Child Tax Credit Worth?

✅ Up to $2,000 per qualifying child under age 17.

✅ Up to $1,600 refundable if you don’t owe taxes.

✅ Phases out for higher-income earners.

🔗 Related: Your Guide to Tax Credits & Deductions

Who Qualifies for the Child Tax Credit?

To claim the CTC, you must meet all of the following conditions:

✅ The Child Must Be:

- Under age 17 at the end of the tax year.

- Your dependent (you must claim them on your tax return).

- A U.S. citizen, U.S. national, or resident alien.

- Living with you for more than half the year.

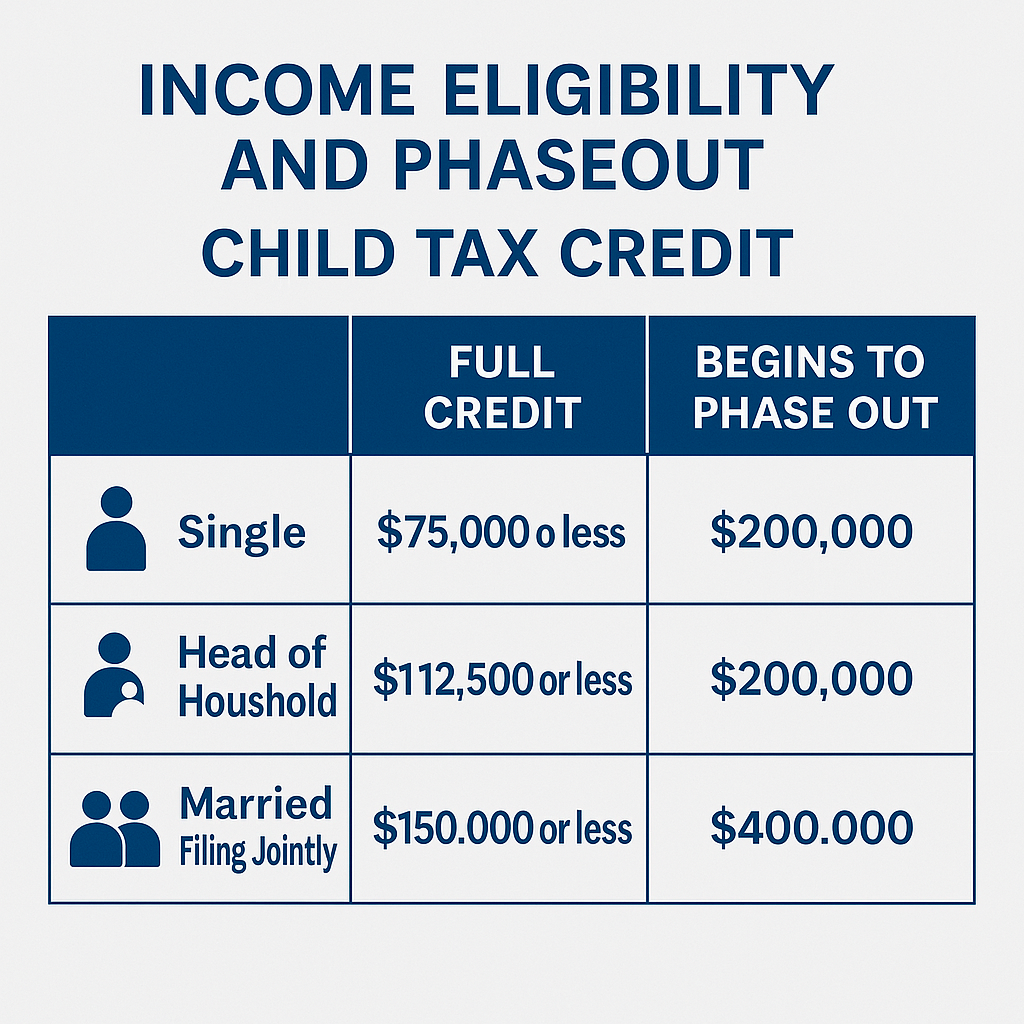

✅ Income Limits for Full Credit

| Filing Status | Income Limit for Full Credit |

|---|---|

| Single | Up to $200,000 |

| Married Filing Jointly | Up to $400,000 |

If your income exceeds these amounts, the credit phases out at a rate of $50 for every $1,000 over the limit.

🔗 Related: Earned Income Tax Credit (EITC) Explained

How to Claim the Child Tax Credit

✅ File Form 1040 and attach Schedule 8812.

✅ Provide your child’s Social Security number (SSN).

✅ Use tax software or a preparer to ensure accuracy.

🔗 Need filing help? Tax Filing Shortcuts

Refundable vs. Non-Refundable Child Tax Credit

- Up to $1,600 is refundable (Additional Child Tax Credit).

- The remaining portion reduces your tax bill but won’t be refunded.

🔗 Learn more: Tax Credit vs. Deduction: What’s the Difference?

Final Thoughts

The Child Tax Credit can lower your tax bill or increase your refund, but you must meet eligibility requirements and income limits.

🚀 Next Steps:

- Confirm your eligibility using the IRS Child Tax Credit Calculator.

- File your tax return correctly to claim the credit.

- Explore additional tax-saving opportunities to maximize your refund.

🔗 Looking for more credits? Visit our Tax Credit Guide.