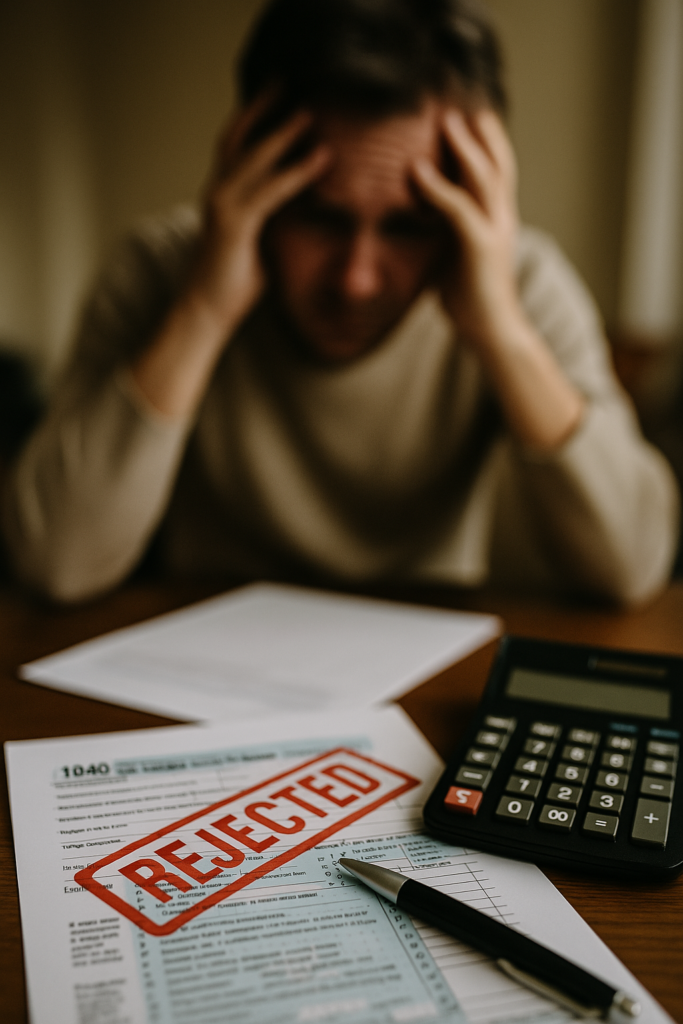

Common Tax Mistakes That Could Cost You Money

Filing taxes incorrectly can result in delayed refunds, IRS audits, and penalties. Avoid these common tax mistakes to keep more of your money and stay compliant.

1. Filing Late or Missing the Tax Deadline

🚨 IRS late filing penalty: 5% per month on unpaid taxes.

🚨 Filing extension doesn’t extend payment deadline—interest accrues on unpaid taxes.

✅ File by April 15, 2025, or request an extension if needed.

🔗 Related: Important IRS Deadlines & Filing Dates

2. Choosing the Wrong Filing Status

✅ Filing Single vs. Head of Household? Head of Household status has a higher standard deduction.

✅ Married couples may benefit from Married Filing Jointly instead of Separately.

✅ Incorrect status can reduce deductions and tax credits.

🔗 Related: Understanding Your 1040 Tax Return

3. Forgetting to Report All Income

🚨 The IRS receives W-2s, 1099s, and investment income statements.

🚨 Failure to report freelance, side gig, or stock sales income can trigger an IRS notice.

✅ Use IRS Form 1099-NEC, 1099-DIV, and 1099-B for accurate reporting.

🔗 Related: IRS Notices & Letters: What to Do If You Get One

4. Overlooking Tax Deductions & Credits

✅ Child Tax Credit (CTC): Up to $2,000 per child.

✅ Earned Income Tax Credit (EITC): Refundable credit for lower-income taxpayers.

✅ Student Loan Interest Deduction: Up to $2,500 deduction on student loan interest paid.

🔗 Related: Your Guide to Tax Credits & Deductions

5. Making Math Errors or Entering Incorrect Information

🚨 Wrong SSN, bank details, or typos can delay refunds.

🚨 IRS processing delays often stem from incorrect calculations.

✅ E-filing reduces errors and speeds up refunds.

🔗 Related: How to Check Your IRS Refund Status

6. Not Keeping Tax Records

✅ IRS audits can occur up to 3 years after filing.

✅ Keep tax documents, receipts, and records for at least 6 years.

✅ Essential for business owners, freelancers, and investors.

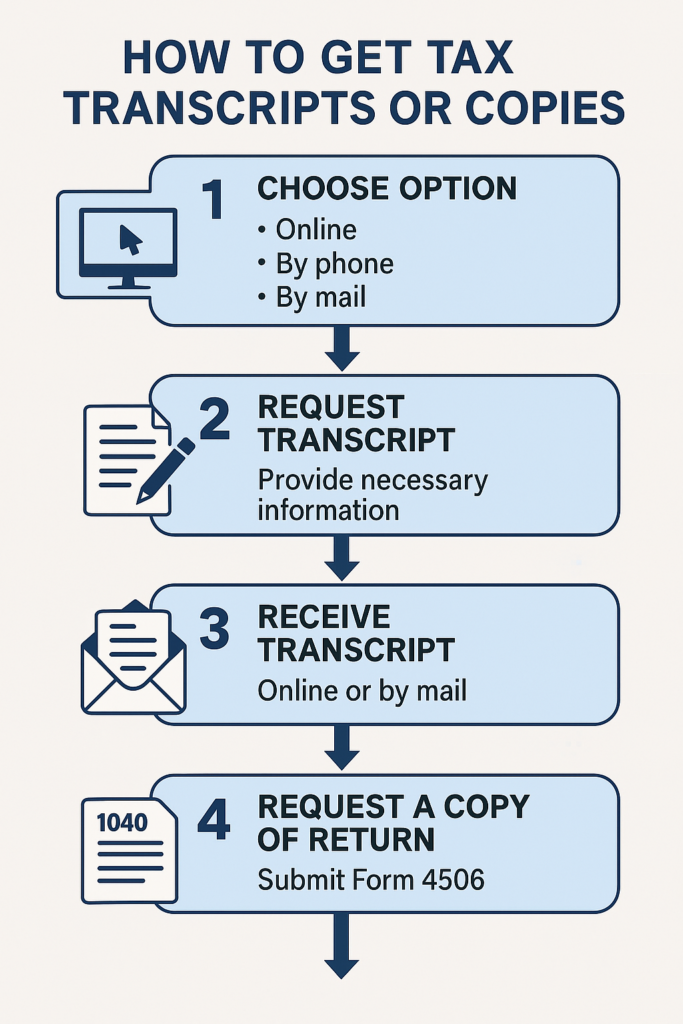

🔗 Related: How to Get Copies of Past Tax Returns

Final Thoughts

Avoiding these common tax mistakes can help you maximize deductions, prevent IRS issues, and receive your refund faster.

🚀 Next Steps:

- File early to avoid last-minute errors.

- Double-check numbers, deductions, and credits.

- Keep proper documentation for IRS compliance.

🔗 Need more tax guidance? Visit our Tax-Saving Blog & Expert Insights.