Following a handful of turbulent years that included a trade war, pandemic, rapid inflation, rising interest rates, a supply chain meltdown and high input costs, U.S. agriculture is hoping to find softer soil as it prepares a march through mid-decade. Here are the biggest factors to watch as 2023 comes to a close.

1. 2023 Farm Income

The ag economy is lukewarm, and the industry is watching to see what could trigger the financial trends of 2024.

“It’s almost impossible to repeat the level of farm income that we had in ’22,” says Jackson Tackach, chief economist with Farmer Mac. “We’re starting to really dial into what ‘23 looks like, and even starting to get a good picture of 2024.”

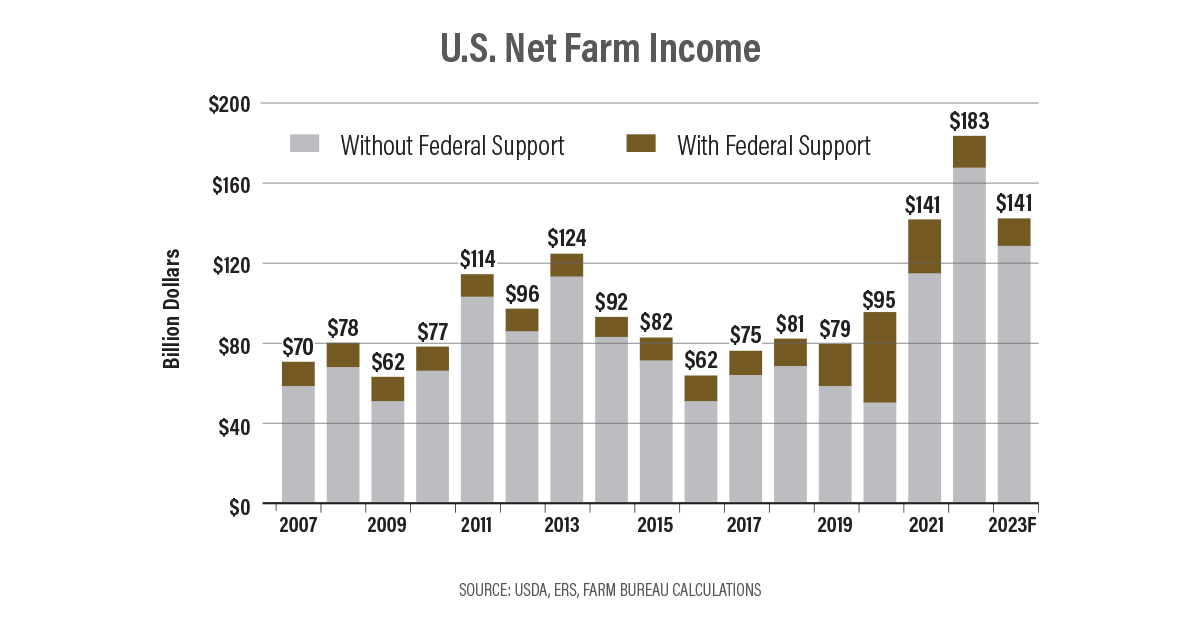

USDA revised its net farm income forecast in August, now calling for a decline of 23% in farm income this year to $141.3 billion. That’s a drop of $41.7 billion versus last year, but it’s still the third-best year on record.

“You have to remember it’s coming down from a very large number of $183 billion in 2022,” says Michael Langemeier, associate director at the Center for Commercial Agriculture at Purdue. “Yes, it’s still a big drop, but we still have relatively strong net farm income compared with the average since 2007, which was the start of the ethanol boom.”

The challenge in 2023 has been production expenses. USDA says expenses are likely to be $458 billion, which is an almost $30 billion increase and up 7% year over year.

“Aside from fertilizer, all your other input costs are probably either stable or increasing,” says Tony Jesina, vice president of insurance at Farm Credit Services of America. “Cash rents haven’t come down yet, seed prices rarely come down, interest rates are up and family living expenses are probably not going to come down given what we’re seeing for inflation.”

Production Holds the Key

Despite drought in nearly half the Corn Belt, production still remains relatively strong.

“On the domestic side we’re expected to have plenty of corn this year,” says Matt Erickson, an ag economist with Farm Credit Services of America. “We look at what USDA put out in the October WASDE, a 14.7% stocks-to-use ratio is above the 10-year average.”

Projected corn-ending stocks of 2.1 billion bushels are above the 10-year average of 1.7 billion.

“It would take corn yields getting down to about 169.7 bu. per acre to drop to that 10-year average,” Erickson explains.

For soybeans, he says the U.S. balance sheet is tight, but South American competition could be a headwind for prices. The impact an El Niño weather pattern could have on South American production remains the biggest wild card going into 2024.

“We’ve seen some relief in some of those input costs, so now it’s really about the revenue and what happens to commodity prices in 2024,” Tackach says.

2. Interest Rates

One of the biggest financial headwinds in 2024 is likely to be higher interest rates. In October, the Kansas City Fed said the average interest rate on various types of farm loans has reached the highest level since 2007 and now stands at 8.34%.

“Interest rates are a little bit higher than in recent history, yes,” says Alan Hoskins, president and national sales director of American Farm Mortgage. “Many farmers have done an excellent job of locking in longer-term rates on the lower end, so we’re not talking about these higher rates affecting their total debt.”

The KC Fed says the financing cost increase is already changing the way some farmers borrow. Those with substantial liquidity are opting to limit their debt usage by tapping into savings from recent prosperous years. Its reports indicate the average operating loan issued this past summer was almost 20% smaller than last year.

“We’re talking about interest rates primarily affecting operating and some equipment loans,” Hoskins says. “I do think most farmers prepared pretty well and tried to make sure their working capital position was solid to withstand some of these challenges of higher interest rates.”

The summer’s average operating loan was nearly $59,000. The volume of operating loans exceeding $1 million has decreased by half versus 2022 while the volume of smaller-sized loans has dropped by 15%.

LOAN TIP

LOAN TIP

Ag banker Alan Hoskins says there are some creative ways for farmers to find lower interest rates. “If folks have cash on hand, instead of using that, and drawing down their cash position, maybe invest a little bit of that money in a CD, which have good returns right now,” Hoskins says. “That can then be borrowed against at a lower interest rate.” Hoskins says not every bank or financial institution will agree to this strategy but for those that will, it’s a win-win. “It allows the bank to have a very secure position because they’re lending against cash,” Hoskins adds. “The farmer, obviously, is going to be earning good interest on that deposit, and only paying interest on the amount of the loan that’s outstanding.”

3. Operating Loans and Lines of Credit

As witnessed in 2023, with the ups and downs of an ag market comes unsteady cash flow. That’s where operating loans and lines of credit are important for continued growth and operational excellence.

“By having a line of credit, you can take advantage of opportunities when you see fit,” says Phil Young, “AgCredit Said It” podcast host and account

officer. “We use it for purchasing things like inputs for the next crop season when prices are lower or having the flexibility to purchase feed when you need it.”

He compares a line of credit (LOC) to a credit card. Producers must make sure they know the terms of when and how the interest is calculated.

“It is a variable rate,” says independent dairy financial consultant Gary Sipiorski. “The interest rate on a LOC normally changes monthly.”

He advises producers to ask their lender these questions:

- Will the LOC have to be paid in full by the end of the year?

- Does it then have to be renewed?

- If the LOC rolls from year to year, when does it mature?

- What is the agreement with the lender in terms of how and for what purposes an LOC can be used?

A LOC is a great cash flow option not only for starting farmers, but also for well-established producers. Financial experts often underscore the importance of understanding these tools, so it can help during a downturn in roller coaster markets.

CREDIT TIPS

CREDIT TIPS

Curtis Gerrits with Compeer Financial offers the following do’s and don’ts of a line of credit.

Do’s

- In times of tight cash flows and decreased income, use a line of credit as an extension of cash flow to stay current with your vendors and operating expenses.

- Set up automatic and regular payments on a line of credit to ensure payment on the principal balances.

- Use a line of credit to prepay expenses for the next fiscal year. This can assist with tax liabilities, and some vendors might offer early discounts.

- Monitor your line of credit closely. Know what you’ve applied to it, along with when and how much you can pay down. This will help you plan and keep the accrued interest at a minimum.

Don’ts

- Do not use a line of credit when cash is sufficient for operating expenses. Avoid creating additional operating costs from increased interest expense when it is not necessary.

- Do not defer to interest-only payments with your line of credit. Set up regular and automated payments to pay down principal balances. You can always pull back funds from the line of credit if needed.

- Do not use your line of credit for purposes they are not intended for.

4 . Land Values

As mortgage rates climb to 20-year highs, near 8%, current high interest rates are eating the housing market. This year is currently on pace to see the fewest home sales since 2008. However, land sales aren’t witnessing the same sticker shock.

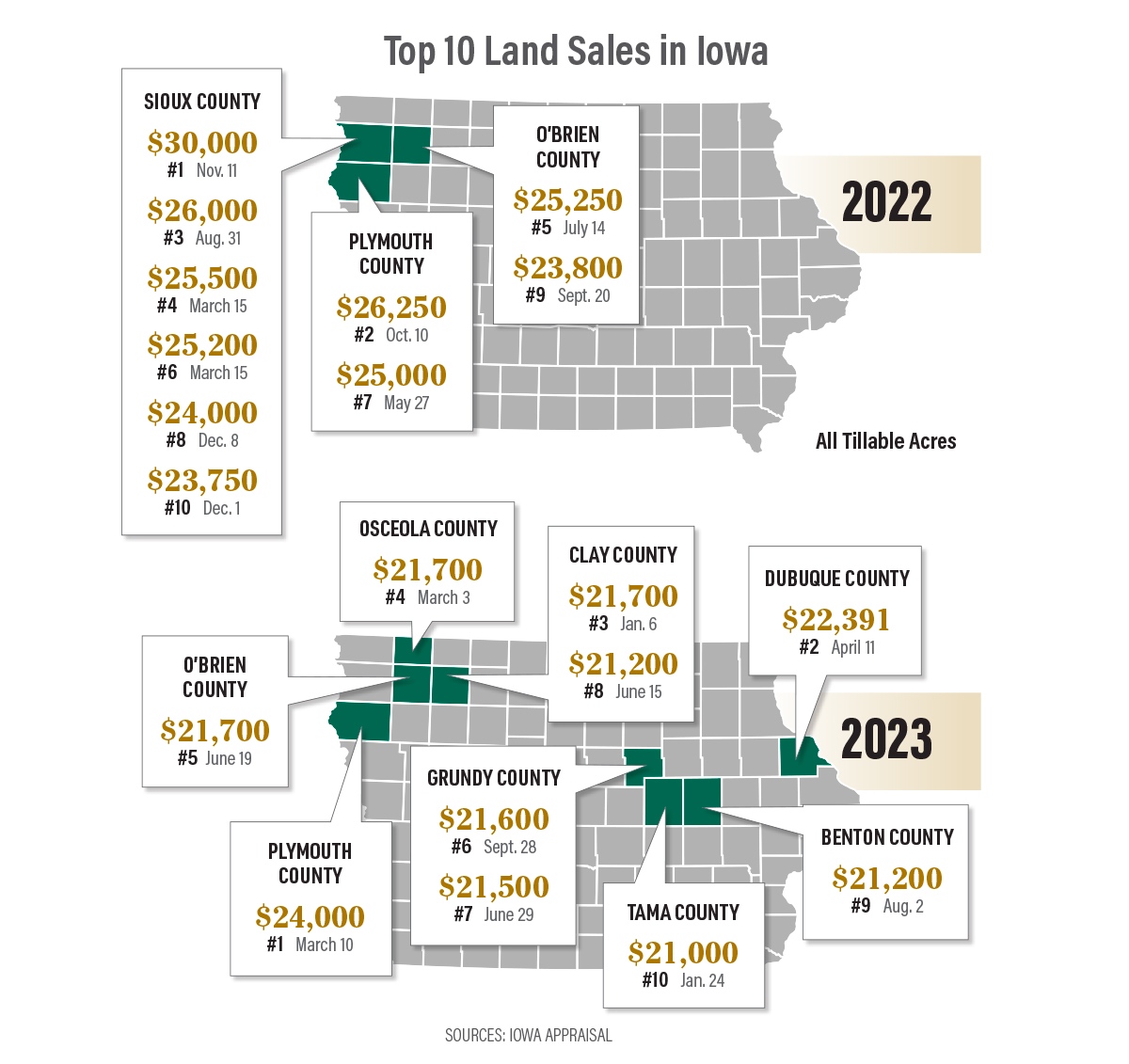

Jim Rothermich, vice president of Iowa Appraisal, tracks sales in the state. He says Iowa land market conditions are steady and strong.

“Since peaking around May 2022, the market has declined a small percentage and is now pretty much in equilibrium, or flat,” Rothermich explains. “Sales north of $20,000 per acre still happen but nothing like they did in 2022.”

While rising interest rates, higher input costs, drought and corn prices below $5 per bushel have put the brakes on the large increases between 2020 and 2022, cash rent auctions still yield solid numbers, he adds.

“I think market conditions will be stable for the next six months to a year,” Rothermich says. “After that, lower farm income and rising interest rates will whittle down land prices. I do not think we’ll see a double-digit decrease, but there is potential for a single-digit decline. Good quality cropland is still in demand.”

When comparing 2023 to the hot markets of 2022, he says it’s clear land values have cooled off.

5. Input Costs

With farm income projected to fall this year, the cost of inputs remains a significant threat to producer margins.

“The problem for growers is corn prices, in relative terms, have come down a little faster, which at first blush, makes it look like 2024 corn is going to be tighter than 2023 on margins,” says Samuel Taylor, senior analyst for farm inputs at Rabobank. “Soybeans look quite a lot stronger

on margins.”

Here’s what to watch for the fertilizer, seed and crop protection price outlooks in 2024.

Fertilizer

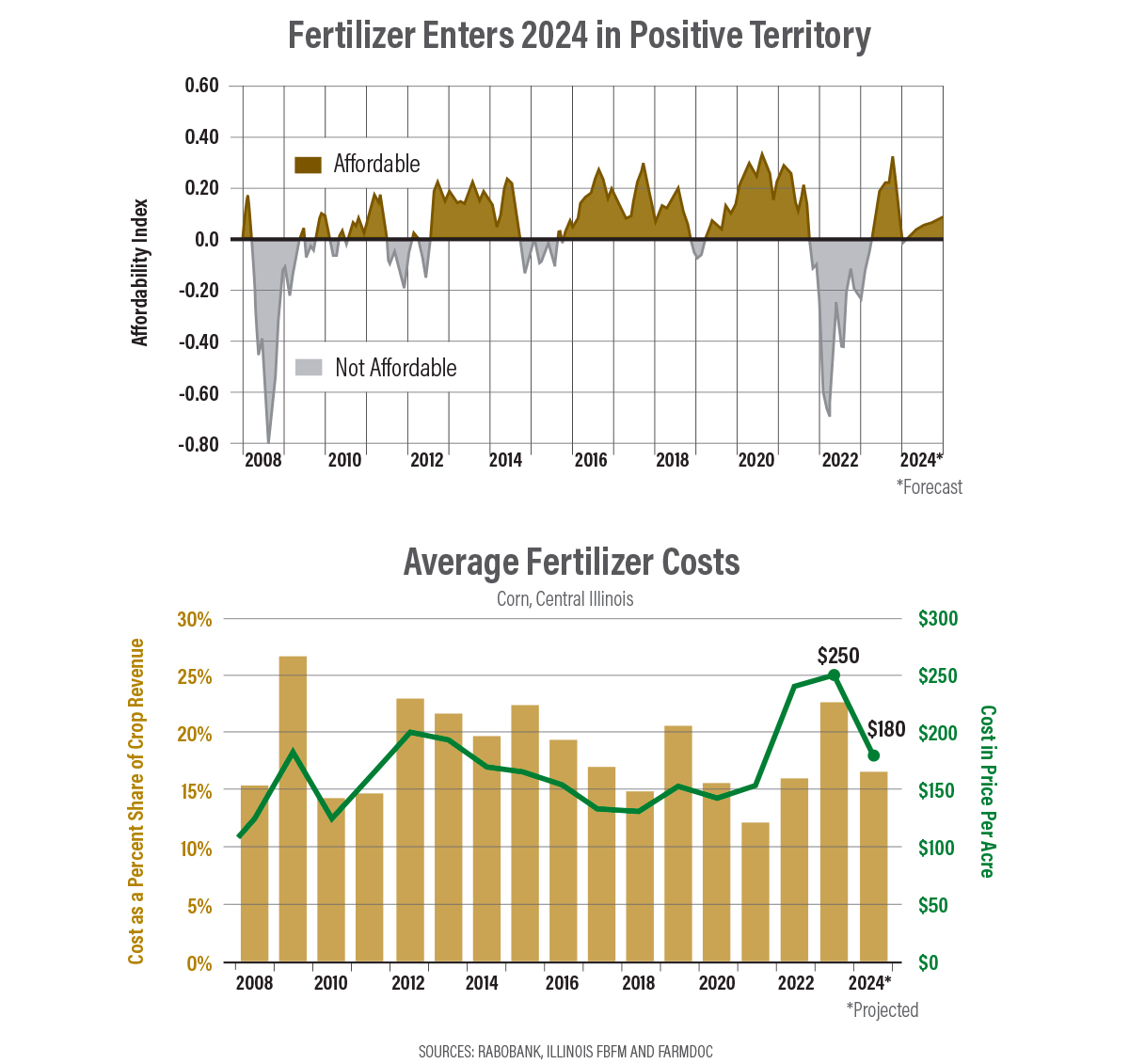

Taylor says the year-over-year change in the company’s fertilizer affordability index has been dramatic.

“At the peak of the Russia/Ukraine crisis, we saw the affordability of fertilizers move to some of the least affordable since 2008,” he says.

“Since then, we’ve seen an adjustment, and there’s a bit more clarity and more re-establishment of the supply chains.”

With that adjustment, Taylor shares the fertilizer affordability index reached one of the most affordable levels in several decades and has now moderated to a more normalized level with wholesale prices still lower than the previous couple of years in the North American market.

“On a year-over-year basis, ammonia is down 50%, phosphates are down a little less than that, but they’re still down in the low teens, and potash prices are down 44%,” he says.

Looking ahead, Taylor anticipates a 4% to 5% increase in fertilizer demand volume in the 2024 season. So far, he says potash and phosphate production in Israel is functioning as normal. However, if disruptions spread, there could be logistical manufacturing issues to watch.

“I think we have to keep an eye on the oil and gas markets,” Taylor says. “Nitrogen prices and natural gas prices are inextricably linked, so it behooves us to monitor.”

Crop Protection

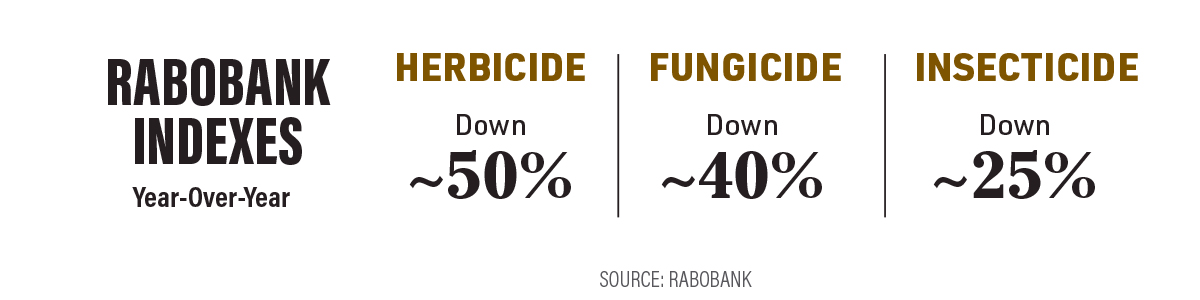

Like fertilizer, prices for agrichemicals are coming down.

Taylor reports the indexes compiled by Rabobank for herbicides, fungicides and insecticides are all showing more affordability.

“We are seeing a near 180° turn on price and inventory from the peaks and scarcity we were experiencing two years ago,” Taylor says. “Some of the biggest retailers we have spoken with have talked about sufficient supplies heading into 2024.”

Seed

One of the input costs that won’t be providing growers with much relief is the price of seed.

“Seed pricing seems to be caught in the vortex of slightly higher cost of production,” Taylor says.

Wholesale soybean seed is expected to be priced more competitively, with a year-over-year change of near 1%. Corn seed prices, however, are up around 5% this year.

FarmDoc Daily from the University of Illinois reports seed costs are projected to reach a record $126 per acre in Illinois for both the 2023 and 2024 crop years.

Though, in terms of overall revenue, they are projecting the seed cost share of crop revenues at 11% in 2023 and 12% in 2024, which is near the average of 11% from 2000 to 2022.

Overall 2024 Outlook

As USDA projects record production expenses for a sixth consecutive year, there are input price improvements.

“Across the board, growers are going to be looking at some of their direct costs of production at a much more favorable level,” Taylor says. “From a margin standpoint, it’s probably going to be a lot more favorable for soybean production.”