IRS Forms & Where to Find Them

Filing your taxes requires the right IRS forms. Whether you’re an individual taxpayer, self-employed, or a business owner, here’s where to find the most important IRS tax forms and instructions.

1. Where to Download IRS Tax Forms

✅ The IRS website: www.irs.gov/forms-instructions.

✅ Tax preparation software (TurboTax, H&R Block) usually provides auto-filled forms.

✅ Your local IRS office or library may carry printed copies.

🔗 Related: What Documents Do You Need to File Your Taxes?

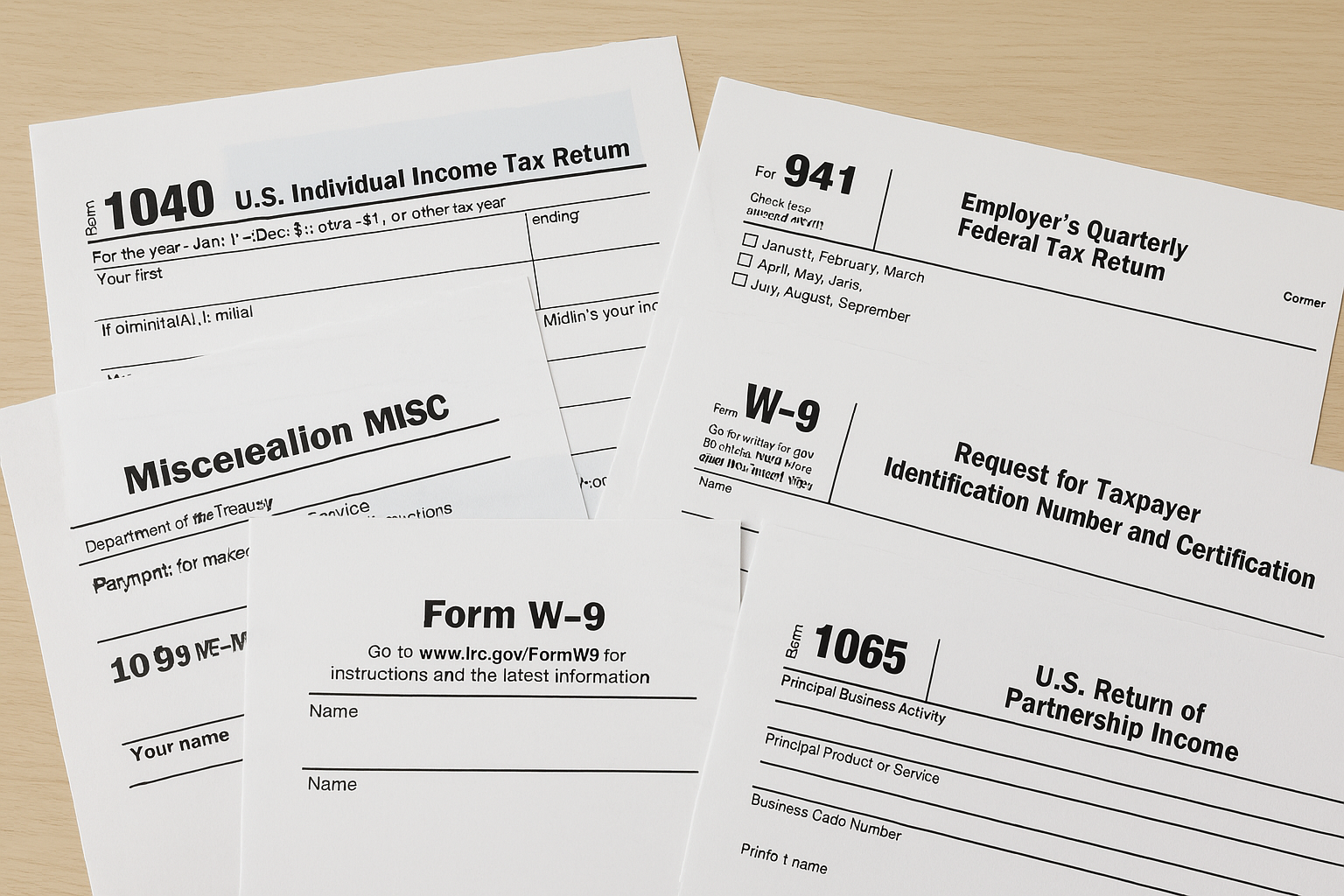

2. Most Common IRS Forms & Their Purpose

| Form Number | Purpose |

|---|---|

| 1040 | Main tax return form for individuals |

| W-2 | Reports wages from an employer |

| 1099-NEC | Reports self-employment income |

| 1099-MISC | Reports miscellaneous income (rents, royalties) |

| 1098 | Mortgage interest statement |

| 8863 | Education credits (American Opportunity & Lifetime Learning) |

| 2441 | Child and dependent care expenses |

🔗 Related: Understanding Your 1040 Tax Return

3. Forms for Self-Employed & Small Businesses

✅ Schedule C – Reports business income and expenses.

✅ Schedule SE – Calculates self-employment tax.

✅ Form 941 – Employer’s quarterly federal tax return.

✅ Form 1065 – Partnership tax return.

✅ Form 1120 – Corporation tax return.

🔗 Related: Self-Employed Retirement Plans: SEP IRA, Solo 401(k), & More

4. How to Request Older Tax Forms

📌 Need past-year forms? Visit IRS Prior Year Forms. 📌 Forms are available for up to 6 years.

🔗 Related: How to Get Copies of Past Tax Returns

5. Need Help Filling Out IRS Forms?

✅ Use IRS Free File if your income is below $73,000.

✅ Visit a Volunteer Income Tax Assistance (VITA) center for free help.

✅ Use tax software to auto-fill and e-file forms correctly.

🔗 Related: Top 10 Frequently Asked Tax Questions

Final Thoughts

Using the correct IRS tax forms ensures you file accurately, claim deductions, and avoid penalties. Always use the latest version and double-check for updates.

🚀 Next Steps:

- Download your required IRS tax forms before filing.

- Use tax software or professional services if unsure about any forms.

- Double-check deadlines and form requirements to avoid IRS penalties.

🔗 Need more tax guidance? Visit our Tax Resource Hub.