IRS Relief Programs: What Help Is Available for Taxpayers?

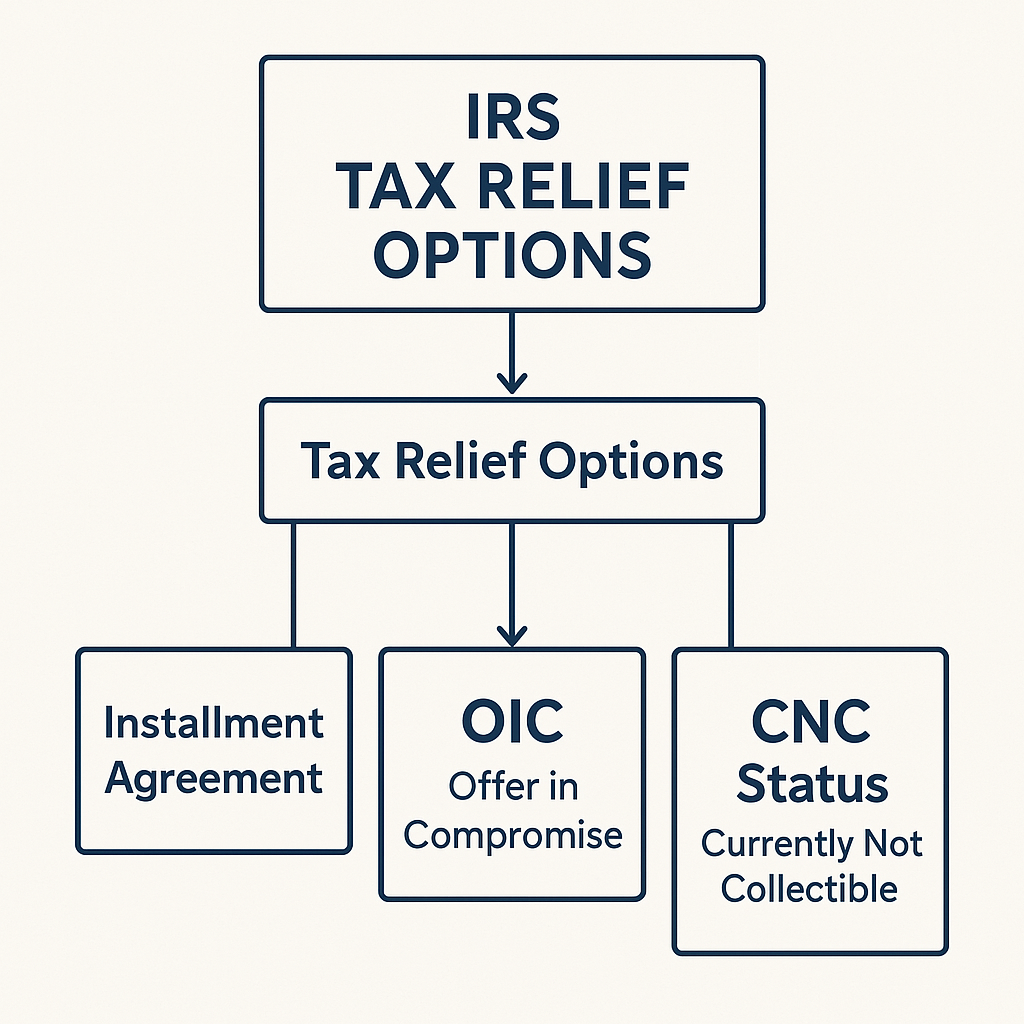

If you’re struggling to pay your tax bill, the IRS offers multiple relief programs to help taxpayers manage their debt. Here’s an overview of the best IRS tax relief options and how to qualify.

1. IRS Payment Plans (Installment Agreements)

✅ Allows you to pay taxes over time instead of in a lump sum.

✅ Available for those who owe $50,000 or less (individuals) or $25,000 or less (businesses).

✅ Interest and penalties still apply.

🔗 Related: How to Apply for an IRS Payment Plan

2. Offer in Compromise (OIC) – Settle Tax Debt for Less

✅ Allows taxpayers to settle their tax debt for less than the full amount owed.

✅ IRS considers income, expenses, and ability to pay.

✅ Only 30-40% of applications get approved, so it’s best to apply with professional guidance.

🔗 Related: Offer in Compromise Guide

3. IRS Fresh Start Program

✅ Helps taxpayers avoid tax liens and levies by offering simplified payment plans.

✅ Increased the debt threshold for Installment Agreements to $50,000.

✅ Reduces penalties for eligible taxpayers.

🔗 Related: IRS Tax Updates & Alerts

4. Currently Not Collectible (CNC) Status

✅ If you can’t afford to pay, the IRS may temporarily stop collection efforts.

✅ You must prove financial hardship (showing that paying taxes would prevent basic living expenses).

✅ Interest and penalties still accrue, but IRS collection actions are paused.

🔗 Related: IRS Notices & Letters: What to Do If You Get One

5. Penalty Abatement – Reduce or Remove IRS Penalties

✅ First-time penalty abatement available if you have a history of filing and paying on time.

✅ Reasonable cause abatement available if illness, natural disasters, or hardships prevented payment.

✅ Can remove failure-to-file and failure-to-pay penalties, but not interest.

🔗 Related: IRS Audit Triggers & How to Avoid an Audit

Final Thoughts

The IRS offers several options for tax relief, but choosing the right program depends on your financial situation. If you owe taxes, act early to avoid collections and additional penalties.

🚀 Next Steps:

- Check if you qualify for an IRS payment plan or Offer in Compromise.

- Apply for penalty abatement if eligible.

- Seek professional help if you’re unsure about your options.

🔗 Need more IRS relief information? Visit our IRS Tax Updates & Alerts Hub.