Traditional vs. Roth IRA: Which One Lowers Your Taxes More?

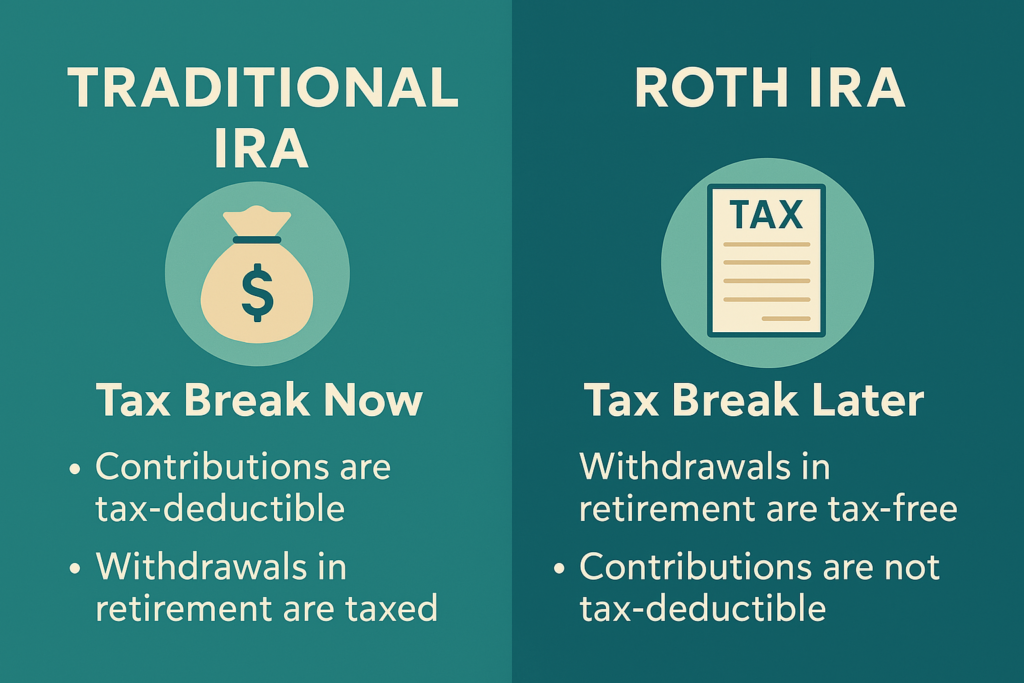

Saving for retirement can also help you save on taxes, but choosing the right IRA is crucial. Here’s how Traditional IRAs and Roth IRAs affect your taxes differently.

1. How Traditional and Roth IRAs Affect Your Taxes

✅ Traditional IRA Contributions: Tax-deductible, reducing your taxable income now.

✅ Roth IRA Contributions: Not tax-deductible, but withdrawals are tax-free in retirement.

✅ Earnings in both accounts grow tax-free.

🔗 Related: How Retirement Contributions Can Reduce Your 1040 Taxes

2. Tax Benefits of a Traditional IRA

📌 Reduces current taxable income.

📌 No taxes on contributions until withdrawal in retirement.

📌 Required minimum distributions (RMDs) start at age 73.

✅ Who Benefits Most?

-

- People expecting lower tax rates in retirement.

-

- Those who need deductions now to lower their 1040 tax bill.

🔗 Read more: How 2025 Contributions to IRA & 401(k) Can Reduce 2024 Taxes

3. Tax Benefits of a Roth IRA

📌 Pay taxes on contributions now, but withdrawals are 100% tax-free in retirement.

📌 No required minimum distributions (RMDs).

📌 Contributions can be withdrawn anytime without penalties.

✅ Who Benefits Most?

-

- People expecting higher tax rates in retirement.

-

- Younger workers with time for tax-free growth.

🔗 Related: The Saver’s Credit: How to Get a Tax Break for Retirement Contributions

4. Contribution Limits & Income Rules

| Account Type | 2024 Contribution Limit | Tax Deductibility |

|---|---|---|

| Traditional IRA | $7,000 ($8,000 if 50+) | Deductible based on income & workplace plan |

| Roth IRA | $7,000 ($8,000 if 50+) | No deduction, but withdrawals are tax-free |

✅ Income Limits for Roth IRA:

-

- Single Filers: Contributions phase out at $146,000–$161,000.

-

- Married Joint Filers: Contributions phase out at $230,000–$240,000.

🔗 Related: Self-Employed Retirement Plans: SEP IRA, Solo 401(k), & More

5. Traditional vs. Roth IRA: Which One Should You Choose?

| Factor | Traditional IRA | Roth IRA |

|---|---|---|

| Tax Benefit | Deducts taxes now | No tax benefit now, but tax-free later |

| Best for… | Lowering this year’s taxes | Tax-free retirement income |

| Required Minimum Distributions? | Yes, at age 73 | No RMDs ever |

🚀 Final Thoughts:

-

- Need tax savings now? Choose a Traditional IRA.

-

- Want tax-free retirement withdrawals? Choose a Roth IRA.

-

- Consider your income, future tax rates, and withdrawal needs before deciding.

🔗 Need more help? Visit our Retirement Tax Savings Guide.