Earned Income Tax Credit (EITC) Explained

The Earned Income Tax Credit (EITC) is a valuable tax benefit for low- to moderate-income workers, reducing taxes owed and potentially increasing refunds. Here’s how it works and how to qualify.

How Much Is the Earned Income Tax Credit Worth?

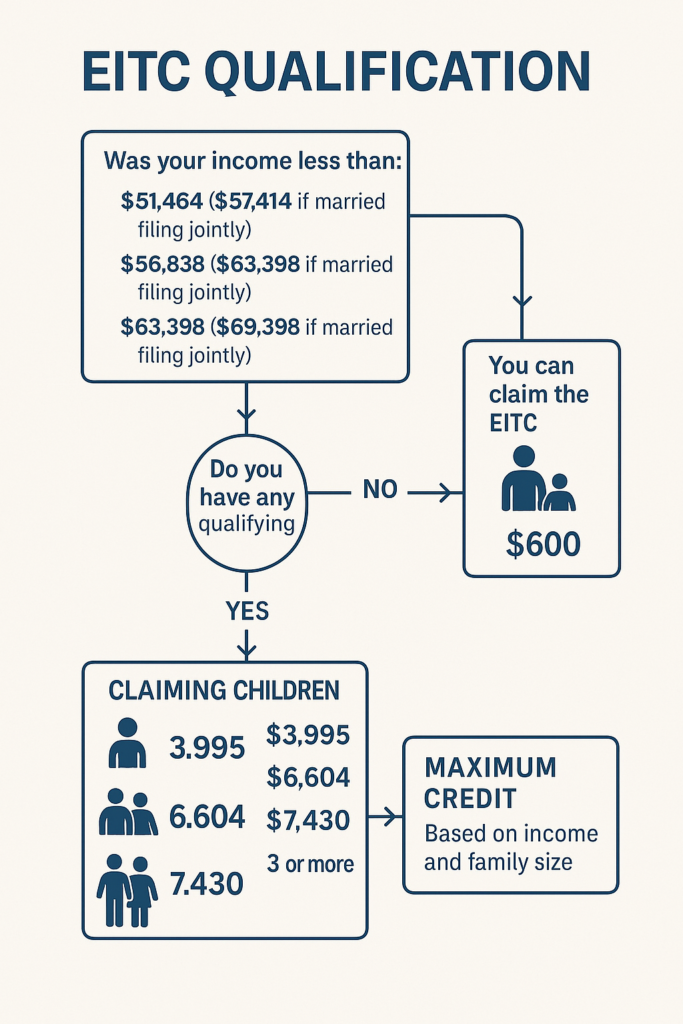

The EITC amount depends on income, filing status, and number of qualifying children:

| Number of Children | Maximum EITC (2024) |

|---|---|

| No Children | $632 |

| 1 Child | $3,995 |

| 2 Children | $6,604 |

| 3+ Children | $7,430 |

🔗 Learn more: Your Guide to Tax Credits & Deductions

Who Qualifies for the EITC?

To claim the EITC, you must meet these requirements:

✅ Earned Income Requirement

- You must have earned income from wages, self-employment, or certain disability payments.

- Investment income must be $11,000 or less.

✅ Adjusted Gross Income (AGI) Limits

| Filing Status | No Kids | 1 Child | 2 Children | 3+ Children |

|---|---|---|---|---|

| Single/Head of Household | $17,640 | $46,560 | $52,918 | $56,838 |

| Married Filing Jointly | $24,210 | $53,120 | $59,478 | $63,698 |

🔗 Related: Who Qualifies for the Child Tax Credit?

How to Claim the EITC

✅ File Form 1040 and complete the EITC worksheet.

✅ Provide Social Security numbers for you and qualifying children.

✅ Use IRS Free File or tax software to ensure accuracy.

🔗 Need help filing? Tax Filing Shortcuts

Refundable Tax Credit – Why EITC Matters

- Fully refundable – If your credit is larger than your tax bill, you get the difference as a refund.

- Helps millions of families boost income and reduce poverty.

🔗 Related: Tax Credit vs. Deduction: What’s the Difference?

Common Mistakes to Avoid

🚨 Filing with incorrect income information – The IRS may audit your return.

🚨 Claiming the EITC when ineligible – The IRS may ban future claims.

🚨 Forgetting to include all dependents – This affects your eligibility and credit amount.

Final Thoughts

The Earned Income Tax Credit is one of the most effective ways for low-income workers to reduce taxes and increase refunds.

🚀 Next Steps:

- Check if you qualify using the IRS EITC Assistant.

- File your tax return accurately to claim the credit.

- Explore additional tax-saving opportunities to maximize your refund.

🔗 Looking for more tax benefits? Visit our Tax Credit Guide.