IRS Payment Plans: How to Pay Your Tax Debt Over Time

If you owe taxes but can’t pay the full amount immediately, the IRS offers several payment plan options to help you settle your debt over time. Here’s everything you need to know about IRS installment agreements.

What is an IRS Payment Plan?

An IRS payment plan (also called an installment agreement) allows taxpayers to pay their tax debt in monthly installments rather than a lump sum. Depending on the amount owed, you may qualify for different types of plans.

Types of IRS Payment Plans

1. Short-Term Payment Plan (Up to 180 Days)

✅ No setup fee.

✅ Must pay the full balance within 180 days.

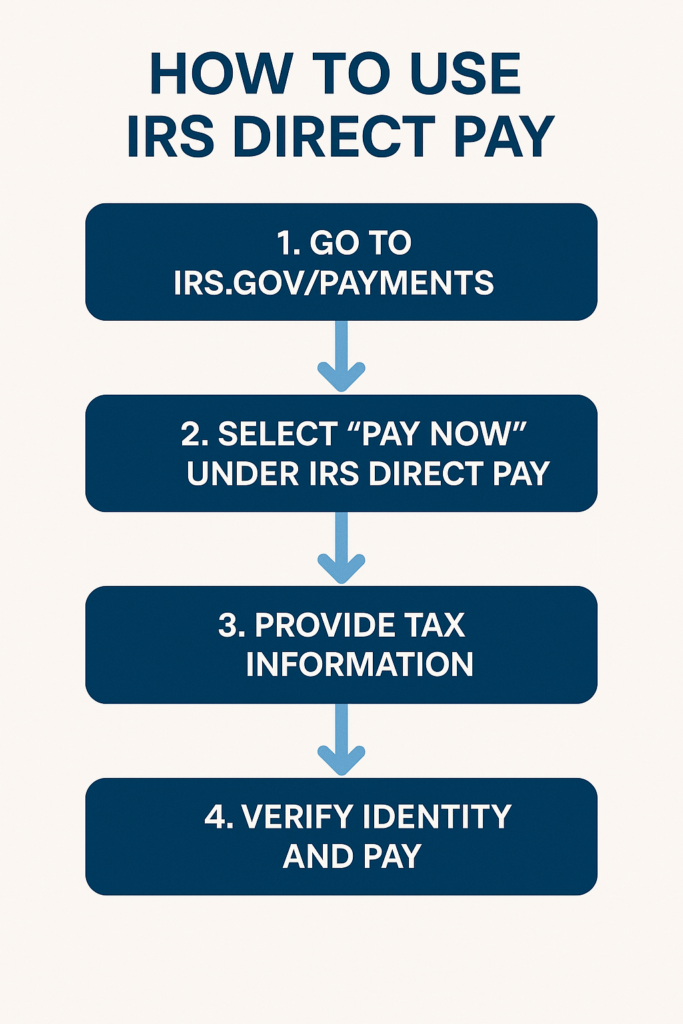

✅ Payments can be made via IRS Direct Pay, debit/credit card, or check.

✅ Apply online or by calling the IRS.

2. Long-Term Payment Plan (More Than 180 Days)

✅ Requires a monthly installment agreement.

✅ Setup fees apply unless you qualify for a low-income waiver.

✅ Payments made via direct debit (recommended) or manually each month.

✅ Interest and penalties continue to accrue until the balance is paid.

How to Apply for an IRS Payment Plan

Online (Easiest & Fastest Method)

- Visit the IRS Online Payment Agreement page.

- Log in or create an IRS account.

- Select the payment plan that fits your situation.

By Phone or Mail

- Call the IRS at 1-800-829-1040 to request a payment plan.

- Complete Form 9465 (Installment Agreement Request) and mail it to the IRS.

Eligibility for IRS Payment Plans

- You owe $50,000 or less (individuals) or $25,000 or less (businesses) in taxes, interest, and penalties.

- You have filed all required tax returns.

- You agree to make monthly payments on time.

🔗 Learn more about IRS Payment Plan Eligibility & Requirements.

IRS Payment Plan Fees & Interest Rates

| Payment Method | Setup Fee | Interest & Penalties |

|---|---|---|

| Direct Debit (Auto Withdrawal) | $31 (waived for low-income) | Continues until paid |

| Manual Payments | $130 | Continues until paid |

| Short-Term Plan (Under 180 Days) | No fee | Continues until paid |

What Happens If You Miss a Payment?

🚨 If you miss a payment, your plan may be canceled, and the IRS may begin collection actions (liens, levies, garnishments). Always make payments on time or contact the IRS if you need adjustments.

Other Options for Tax Debt Relief

- Offer in Compromise (OIC): Settle for less than what you owe.

- Currently Not Collectible (CNC): Delay collections if you’re in financial hardship.

- Penalty Abatement: Request to remove certain IRS penalties.

🔗 Need help settling your tax debt? Read our guide on How to Settle IRS Tax Debt.

Final Thoughts

If you owe the IRS, setting up a payment plan can help you avoid aggressive collection actions. Act now to get your tax debt under control.

🚀 Ready to apply? Start with our Filing & Paying Back Taxes Guide.